As Economies battle, Can Bitcoin Accomplishment in an International Economic downturn?

The United States is having a hard time to confess that the economy remains in economic crisis. That’s regardless of a current caution by the World Bank that the United States, China, Eurozone, and other significant economies are greatly slowing into economic crisis with devastating long-lasting results on establishing economies.

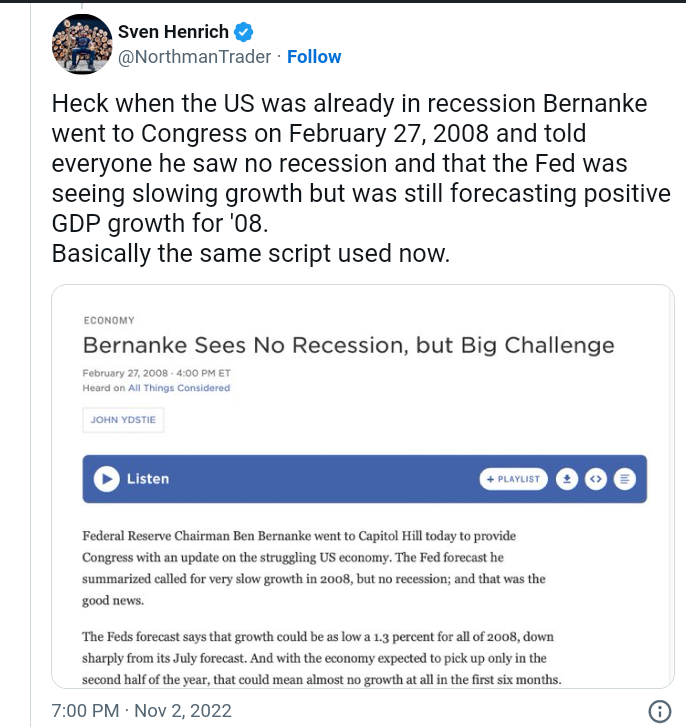

Provided the debate created by its playbook to the 2007/08 economic crisis, Washington might have selected to make difficult options behind the cover of willed opacity. In the situations, Bitcoin’s safe house pledge has actually entered into focus when again.

What function could the crypto property play at a time of financial unpredictability?

United States: ‘we are not in an economic downturn’

A Reuters survey of economic experts and independent observations by leading CEOs that the U.S might tip into economic crisis next year accept a World Bank report that the worldwide economy remains in its steepest downturn because 1970.

Washington, nevertheless, has actually consistently dismissed issues over the economic crisis. “We are not in economic crisis,” U.S President Joe Biden leading assistant informed MSNBC on Nov. 3, on the back of favorable work information. “The economy is growing. It is strong. It is developing tasks.”

Previously, press secretary Karine Jean-Pierre highly dismissed issues that the nation is getting in economic crisis. “We are not … there are no conferences or anything like that occurring in getting ready for an economic downturn … what we are seeing today is a strong labor market.”

The White Home’s identified rejection to acknowledge the elephant in the space might be a little too strong. It is difficult to picture that economic crisis is entirely off the program in the United States. Based upon the interconnectedness of a worldwide economy that is taking an unmatched whipping this year.

America’s crucial trading partner, the U.K, has actually exposed that it is facing its longest economic crisis because dependable records started in the 1920s. GDP development is anticipated to decrease by around 0.75% in the 2nd half of 2022, and fall even more over the next 2 years.

Joblessness will double to 6.5% throughout the two-year financial slump, according to the Bank of England.

World Bank: ‘we are edging towards a worldwide economic crisis’

The World Bank report anticipated an interconnected worldwide slump that will spill down to the worldwide south. It states a worldwide economic crisis is currently in the making as reserve banks have actually raised rates at a degree of synchronicity not seen in the previous 50 years.

” Financiers anticipate reserve banks to raise worldwide monetary-policy rates to nearly 4% through 2023– a boost of more than 2 portion points over their 2021 average,” stated the report.

Disallow the easing of supply disturbances and labor-market pressures, rates of interest walkings might leave the worldwide core inflation rate, omitting energy, at about 5% in 2023, it mentioned. That’s nearly double the five-year average prior to the covid-19 pandemic.

” The world’s 3 biggest economies– the United States, China, and the euro location– have actually been slowing greatly. Under the situations, even a moderate hit to the worldwide economy over the next year might tip it into economic crisis,” stated David Malpass, the bank’s president.

Closed-door sausage-making

The Joe Biden administration’s overpromising tone in the face of contrary information by extremely positioned sources indicate 2 prospective factors. One would be an isolationist certitude stagnated by what is occurring worldwide.

Even if its economy was undisputable, it is unexpected that inflationary actions by world reserve banks, a recession of record percentages in the U.K, and a synchronised downturn in China and the Eurozone, would not awaken the United States into alert mode.

Yet, Biden’s press secretary will have the world think that Washington is not holding any conferences whatsoever. Another factor for the White Home’s overpromising tone in the face of combined tensions might be willed opacity.

Formally acknowledging economic crisis might send out unanticipated triggers through the marketplaces. However the United States can not just purchase time or want away the inescapable. It might just have actually selected to eliminate fire behind the scenes.

Hilary Clinton infamously informed a closed-door Goldman Sachs conference that politics resembles making sausage, according to dripped e-mails released by Wikileaks. There may be no takers if the general public saw the procedure.

Following the 2008 economic crisis, Barack Obama’s stimulus bundle was a case of unpalatable sausage-making.

Britain’s unsure slouch into economic crisis has actually currently seen it going in between 3 prime ministers in the area of a couple of months. The United States democracy is simply as filled and polarized today. Closed-door sausage-making is an alternative for Biden as long as he can handle it.

The Bitcoin option

Surprisingly, Bitcoin (BTC) traces its roots to the angst of the 2007/08 economic crisis. Creator Satoshi Nakamoto blogged about the bailout of banks, yet hidden in the U.K, in the genesis block of Bitcoin 13 years earlier.

” The Times 03/Jan/2009 Chancellor on verge of 2nd bailout for banks,” composed Nakamoto, the enigmatic pseudonymous developer of Bitcoin.

Among Bitcoin’s engaging usage cases was the possibility of safeguarding your financial resources from unilateral federal choices. Like the questionable bailing out of industrial lending institutions utilizing public funds after the subprime-mortgage crisis in 2009.

Another usage case was Bitcoin’s prospective to endure difficult times. Negotiated outside the ambit of reserve bank policies and inflationary actions, BTC has actually been frequently gone over in the exact same breath with gold, especially because the pandemic triggered worries of inflation.

Bitcoin’s connection to gold has actually increased greatly over the previous 2 years. Bloomberg product strategist Mike McGlone formerly stated that the crypto property will ultimately shift from a risk-on speculative property to the crypto market’s variation of the metal.

As digital gold, Bitcoin attract the cashless web economy mainly on account of its attributes that consist of day-and-night cost openness, and the absence of limitations, disturbances, or third-party oversight.

Sovereignty from realpolitik

It is not yet adequately clear though, that Bitcoin can preserve its sovereignty from realpolitik. Worldwide crises, consisting of the Russian intrusion of Ukraine, accompanied a significant fall in the worth of Bitcoin, which struck a multi-year low of about $17,500 in June.

Heavy-handed policing of cryptocurrency by the United States, in specific, in action to its capacity for sanction-busting and geopolitical video games, has actually likewise debunked the property’s aura as a self-referential sanctuary.

However Bitcoin can have its 2nd 2009 minute by acting as a hedge to inflation and a safe house for financiers. The obligation needs to start with the crypto neighborhood. Bitcoin requires to innovate in keeping with the cypherpunk worths of Satoshi Nakamoto.

It must weaken increased intrusions into its universe by nation-state stars, and progress beyond its present connection to the stock exchange. In this capability, BTC is not just conscious financial information which shapes and ‘unshapes’ economic downturns, however likewise speculative propensities.

Wharton teacher Jeremy Siegel informed a Bloomberg podcast today that United States stocks will increase in between 20% to 30% over the next 2 years, and home costs will decrease as much as 15% from their peak.

” Stocks are rather underestimated. If you purchase stocks, in a number of years, you’re going to be really pleased,” Siegel discussed, including:

” If you have actually got that long horizon and you’re young today, this is a golden time. You’re not purchasing at the top. You’re purchasing near the bottom. You are going to be ensured excellent returns when you retire.”

Lots of crypto experts argue that Bitcoin reached a bottom with its June lows. By the exact same procedure, the digital property might stand apart throughout the anticipated worldwide economic crisis, tracking the stock exchange, in line with Siegel’s projections.

Bitcoin’s self-reflexivity

The World Bank’s bleak projection provides couple of prescriptions. Developing economies are motivated to preserve foreign currency reserves. Gains from this will be just relative as location currencies will likely have actually taken a whipping too.

For people looking into the void, BTC’s quality as a safe house enters focus. Still, Marxist champs of digital liberty like Slavoj Zizek and Yanis Varoufakis have actually declined to glamorize Bitcoin.

They complain its usage case as a method of speculation. Zizek is more reproachful to the self-referential nature of speculation in cryptocurrency, its obvious development of exchange worth out of absolutely nothing.

Paradoxically, the self-reflexivity of Bitcoin would be perfect now more than ever however even Zizek might have overemphasized things. The range in between Bitcoin and the imperfect world of federal governments, reserve banks and real-life financial investments has actually been decreased.

Got something to state about this short article, or anything else? Compose to us or sign up with the conversation on our Telegram channel. You can likewise capture us on Tik Tok, Facebook, or Twitter.

For BeInCrypto’s most current Bitcoin ( BTC) analysis, click on this link

Disclaimer

All the info included on our site is released in great faith and for basic info functions just. Any action the reader takes upon the info discovered on our site is strictly at their own threat.