Banking Deposits Drop as Investors Leave to Volatile Bitcoin

United States banks’ deposits dropped considerably in between March 8 and March 15 due to worries of a banking collapse. On the other hand, Bitcoin increased 35% over the last 2 weeks.

Information from the Federal Reserve revealed that deposits at all U.S. industrial banks fell by $98 billion within that week however increased by $67 billion for the leading 25 banks in the nation. This recommends that consumers moved their funds from local banks to banks thought about too huge to stop working– signaling worry of a banking collapse.

This habits likewise highlights the issue that the federal government may not assist the smaller sized banks, specifically if they are ruled out systemically crucial. Gemini co-founder Tyler Winklevoss explained the U.S. banking system as a modern-caste system where individuals banking with the leading banks are safeguarded while the rest are exposed to threats.

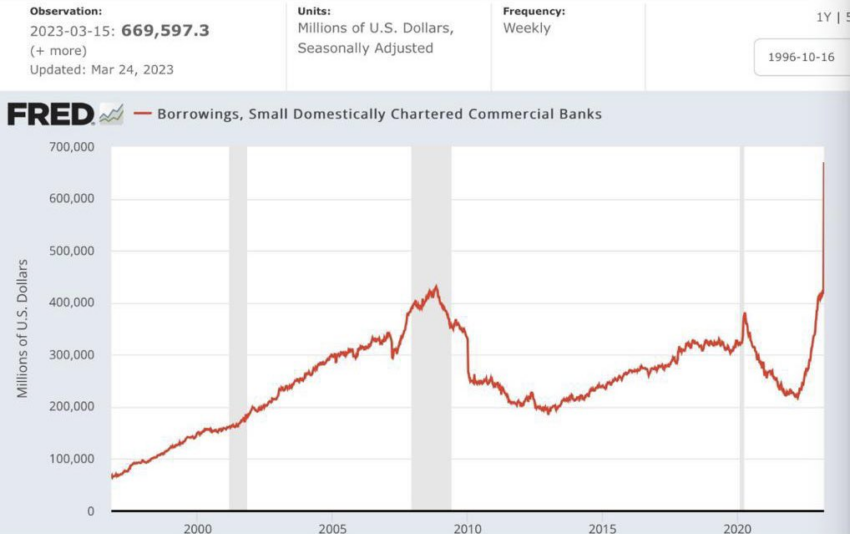

Banks Obtaining at Unprecedented Rates

On the other hand, the federal government and significant banks’ transfer to calm nerves has not completely reduced issues about a possible crisis in the banking system. Numerous users are still moving funds out of little banks, leading the banks to obtain at a worrying rate to avoid bank runs.

CNN reported that loaning by little U.S. banks reached the greatest rate because the millenium. According to the report, the banks obtained $669.6 billion today. However experts think this is simply an effort by the banks to get ready for any bank run and does not always indicate a present issue.

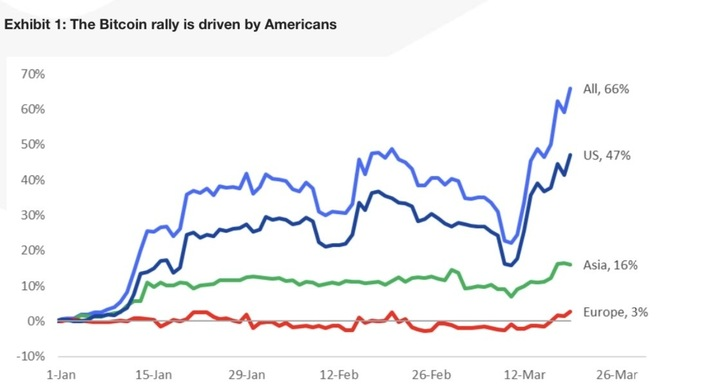

United States Financiers Stack Into Bitcoin

A take a look at Bitcoin’s current rally revealed that U.S. financiers had actually played a considerable part in the cost increase. According to Matrixport’s head of research study and method, Markus Thielin, “Americans are purchasing Bitcoin with both hands.” Thielen kept in mind that 47% of the purchases that sustained BTC’s cost boost originated from U.S. institutional gamers.

Coinbase previous CTO Balaji Srinivasan mentioned that financiers normally leave decreasing the value of currencies throughout distress. According to him, this is where the U.S. Dollar falls under currently, including that he anticipates Bitcoin ( BTC) to change it as the international reserve currency.

Throughout this banking crisis, Bitcoin has actually rallied by 35% in the last 2 weeks to as high as $27,944. Numerous BTC bulls have actually anticipated the impending collapse of the banking system and the possibility of the flagship property rallying to $1 million.

Disclaimer

BeInCrypto has actually connected to business or private associated with the story to get a main declaration about the current advancements, however it has yet to hear back.