Bitcoin and Ethereum Look Set to Break Out

Secret Takeaways

Bitcoin acquired over 1,000 in market price early Monday.

On the other hand, Ethereum saw its cost dive above $1,800..

The technicals and principles now indicate additional gains on the horizon..

Share this short article

The overall cryptocurrency market capitalization has actually increased by approximately $49 billion because the start of Monday’s trading session, assisting Bitcoin and Ethereum post considerable gains.

Bitcoin and Ethereum increasing

Bitcoin and Ethereum have actually begun the week in the green, indicating the start of a brand-new uptrend.

The leading cryptocurrency has actually gotten over 1,000 points in market price following the opening of Monday’s trading session. The abrupt spike in upward pressure shocked numerous cryptocurrency lovers provided the dominating macroeconomic unpredictability. Still, Bitcoin appears to have actually breached an essential resistance location that might permit it to advance even more.

From a technical viewpoint, BTC bounced off the middle trendline of a parallel channel that had actually established on its everyday chart. The technical development recommends that it might now march towards the upper trendline at around $25,700. Bitcoin needs to continue trading above the $23,300 assistance level to accomplish its upside capacity.

On-chain information include credence to the technical outlook as IntoTheBlock’s In/Out of the cash Around Rate (IOMAP) design reveals that Bitcoin has actually established a substantial assistance flooring. Approximately 1.4 million addresses acquired over 1 million BTC in between $22,650 and $23,325. The considerable quantity of interest around this level might assist consist of any spike in profit-taking, possibly permitting rates to rebound.

It deserves keeping in mind that the IOMAP reveals little to no considerable resistance ahead. The most significant supply barrier is $26,670, where 63,530 addresses have actually formerly acquired over 181,270 BTC.

Ethereum has actually likewise gotten considerable bullish momentum today. The increasing purchasing pressure has actually assisted ETH’s cost rise by almost 7%, striking a high of $1,800 at press time. As speculation installs around the blockchain’s long-awaited “Combine” upgrade, it appears that ETH has more space to ascend.

The second-largest cryptocurrency by market cap has actually broken out of a balanced triangle that had actually established on its four-hour chart. The height of the pattern’s Y-axis recommends that Ethereum might now get in a 22.5% uptrend. More bullish momentum might assist ETH confirm the positive outlook and reach $2,130.

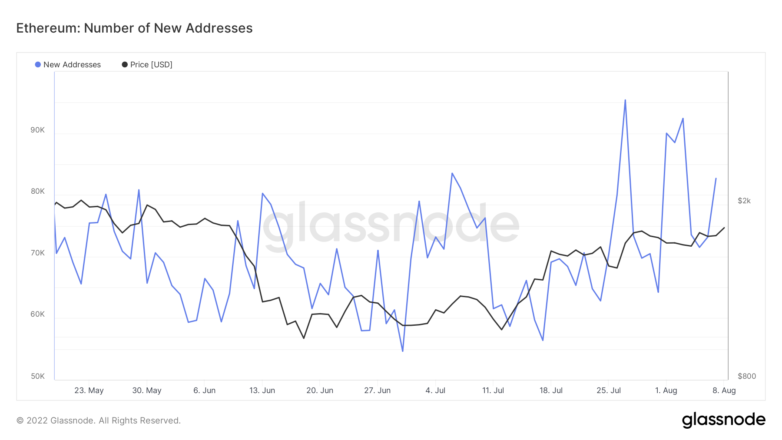

On-chain activity likewise suggests a spike in interest for Ethereum. The variety of brand-new everyday addresses on the network seems increasing, developing a series of greater highs and greater lows. The uptrend recommends that sidelined financiers have actually been building up ETH around the present cost levels.

Network development is frequently thought about among the most precise cost predictors for cryptocurrencies. Usually, a constant boost in the variety of brand-new addresses produced on a provided blockchain results in increasing rates gradually.

Regardless of the enhancing technical and basic conditions, ETH needs to stay trading above $1,700 to continue trending up. If it drops listed below the vital level, it might deal with a sell-off that revokes the bullish thesis and activates a correction to $1,600 and even $1,450.

Disclosure: At the time of composing, the author of this piece owned BTC and ETH.

For more crucial market patterns, register for our YouTube channel and get weekly updates from our lead bitcoin expert Nathan Batchelor.

Share this short article

The details on or accessed through this site is acquired from independent sources our company believe to be precise and trustworthy, however Decentral Media, Inc. makes no representation or service warranty regarding the timeliness, efficiency, or precision of any details on or accessed through this site. Decentral Media, Inc. is not a financial investment consultant. We do not provide customized financial investment recommendations or other monetary recommendations. The details on this site goes through alter without notification. Some or all of the details on this site might end up being out-of-date, or it might be or end up being insufficient or unreliable. We may, however are not obliged to, upgrade any out-of-date, insufficient, or unreliable details.

You ought to never ever make a financial investment choice on an ICO, IEO, or other financial investment based upon the details on this site, and you ought to never ever analyze or otherwise depend on any of the details on this site as financial investment recommendations. We highly suggest that you seek advice from a certified financial investment consultant or other competent monetary expert if you are looking for financial investment recommendations on an ICO, IEO, or other financial investment. We do decline payment in any kind for examining or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or products.

See complete terms.