Bitcoin Choice Markets Keep Sending Out Bullish Signals– Here’s the Ramifications for BTC Cost

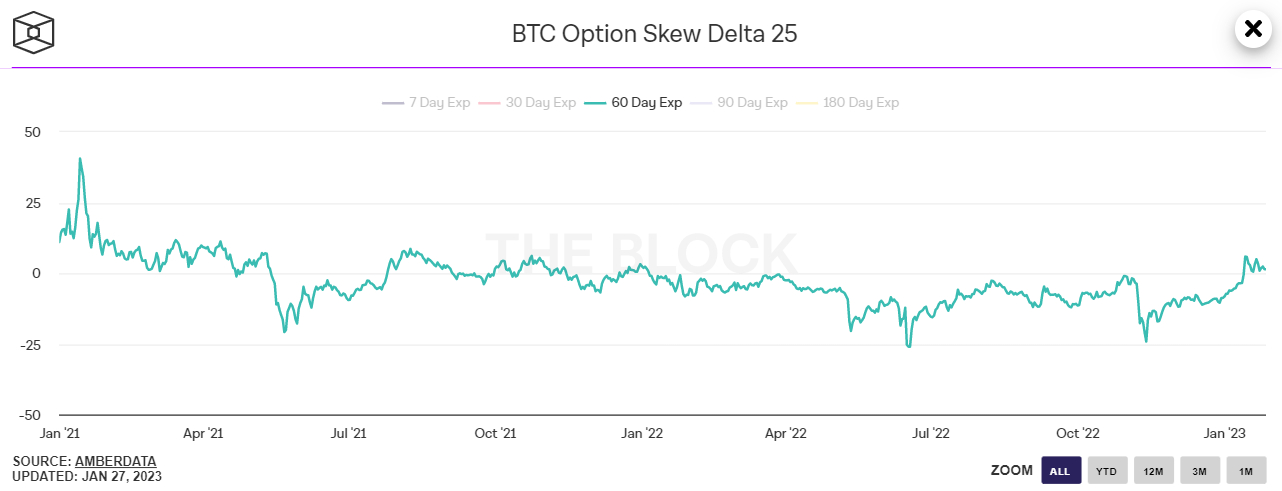

Bitcoin alternatives markets continue to signify that financiers are preparing for even more upside in the BTC cost. According to a chart on The Block, the extensively followed Bitcoin 25% delta alter has actually stayed above absolutely no considering that the middle of January and just recently struck its greatest considering that Q4 2021 at near to 6.0.

The 25% delta alternatives alter is a widely kept an eye on proxy for the degree to which trading desks are over or undercharging for advantage or drawback defense through the put and call alternatives they are offering to financiers. Put alternatives offer a financier the right however not the responsibility to offer a property at a fixed cost, while a call choice provides a financier the right however not the responsibility to purchase a property at a fixed cost.

A 25% delta alternatives alter above 0 recommends that desks are charging more for comparable call alternatives versus puts. This indicates there is greater need for calls versus puts, which can be translated as a bullish indication as financiers are more excited to protect defense versus (or bank on) an increase in costs.

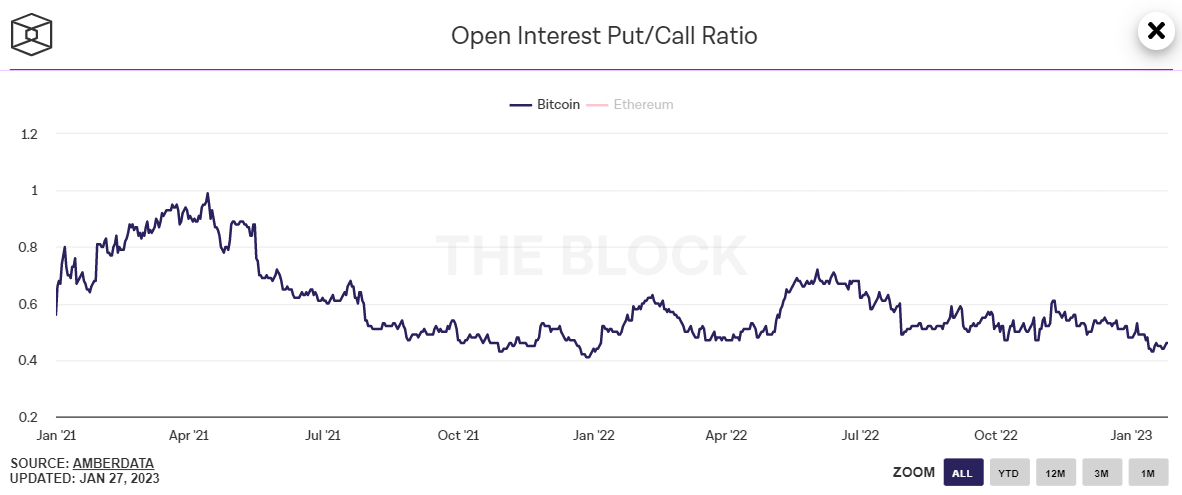

Open Interest Put/Call Ratio Likewise Points To Strong BTC Belief

The continual increase in Bitcoin’s 25% delta choice alter is an indication that financier belief towards the world’s biggest cryptocurrency by market capitalization has actually taken a considerable turn for the much better in January. Another alternatives market indication called the Open Interest Put/Call Ratio is likewise signifying a healing in belief.

According to a chart on the Block, the ratio in between open BTC put and call alternatives on derivatives exchange Deribit was last at 0.46, near to its most affordable considering that January 2022. It surged as high as 0.61 in the instant consequences of the FTX cryptocurrency’s collapse in early November.

Financiers Betting That the Bearishness is Over?

Bullish signals relating to the sort of defense financiers are requiring in the Bitcoin alternatives market contribute to a growing list of reasons financiers, experts and analysts alike are significantly taking the view that the current rebound in Bitcoin’s cost might not simply be another so-called “bearishness rally”, as occurred time and time once again in 2022, however might be the start of a wider market healing.

As covered in a current short article, 6 out of 8 indications seen by experts at crypto information analytics platform Glassnode to determine when Bitcoin is transitioning out of a bearish market are flashing bullish signals, and a seventh is most likely to likewise quickly turn green.

On the other hand, 2022’s macro headwinds seem easing off. United States inflation is quickly dropping to more appropriate levels and with the United States economy grinding to a stop based on current study information and business revenues, the bond market’s evaluation that the Fed will not have the ability to tighten up rates a lot more in 2023 is appearing like a progressively precise call.

This story has actually been a crucial motorist of Bitcoin’s 2023 rally up until now, and numerous believe might even more support its cost in the months ahead. While some continue to deride the current relocation higher as simply another bearishness rally, the above-noted indications in Glassnode’s control panel recommend that this most current relocation higher might well be something more.

Extra Indications of Market Healing

In other places, the extensively followed Bitcoin Worry & & Greed Index just recently returned into neutral area (i.e. above 50) for the very first time after an extended spell of Worry and Extreme Worry. A long lasting healing back into neutral typically comes at the start of the next Bitcoin booming market, such as in early 2019 and after that once again in mid-2020.

On the other hand, analysis from crypto-focused Twitter account @CryptoHornHairs made a jaw-dropping observation that Bitcoin is following nearly precisely in the steps of a near-four-year market cycle that it has actually been following for the past more than 8 years. After bottoming last November, Bitcoin might rally for another almost 1000 days, the analysis recommends, prior to entering its next bearishness in 2025.

Furthermore, a commonly followed Bitcoin rates design is sending out a comparable story. According to the Bitcoin Stock-to-Flow rates design, the Bitcoin market cycle is approximately 4 years, with costs generally bottoming someplace near to the middle of the four-year space in between “halvings”– the Bitcoin halving is a four-yearly phenomenon where the mining benefit gets cut in half, hence slowing the Bitcoin inflation rate. Previous cost history recommends that Bitcoin’s next huge rise will follow the next halving in 2024.