Bitcoin Exits Suitable Purchasing Zone: Now What?

As Bitcoin continues to progress and grow, traders and financiers are constantly looking for methods to make wise financial investment choices. One important tool they utilize are on-chain indications, offering important insights into the marketplace’s efficiency and possible purchasing chances.

Amongst these indications, the MVRV, NUPL, and Puell Numerous, which are all outside the perfect purchasing variety for optimum earnings.

Bitcoin Reaches Technical Resistance

MVRV is an on-chain crypto market indication that represents the relationship in between the marketplace capitalization and the recognized capitalization of a property. It’s determined by dividing the marketplace capitalization by the recognized capitalization and is utilized to examine the present state of the marketplace and make financial investment choices. A worth listed below 1 is thought about a chance for purchasing and a worth above 1 is thought about an indication of overvaluation.

The MVRV ratio is presently at 1.16, as it has actually come out of the purchasing zone listed below 1. As this indication is presently dealing with stiff resistance, it is necessary to keep an eye out for a break of the 1.19 level. Conquering this obstacle might activate a growth towards 1.34, which has actually traditionally shown to be a tough wall to break.

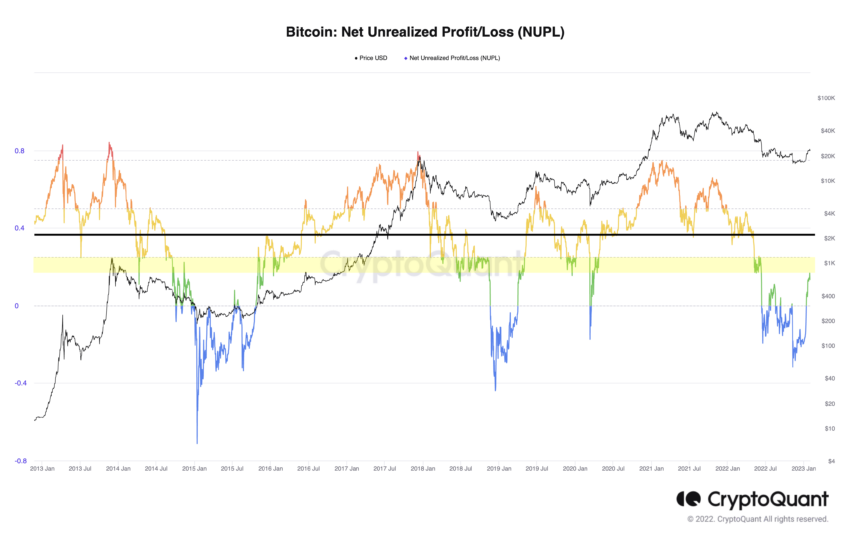

The NUPL is a cryptocurrency metric utilized to track the circulation of earnings and losses amongst holders of a specific token. It determines the present worth of the tokens held by a user relative to the cost at which they were obtained. The NUPL metric can offer insights into the general belief of a cryptocurrency’s financiers and traders, and is a beneficial tool for making financial investment choices.

The NUPL has actually seen a current boost, causing a remarkable increase in its worth, presently at 0.14, greater than prior to the FTX crash. However, financiers who purchased prior to Might 9, 2022, are still not in earnings and might offer when they recover cost, with a downswing listed below the 0 level, providing a perfect purchasing chance.

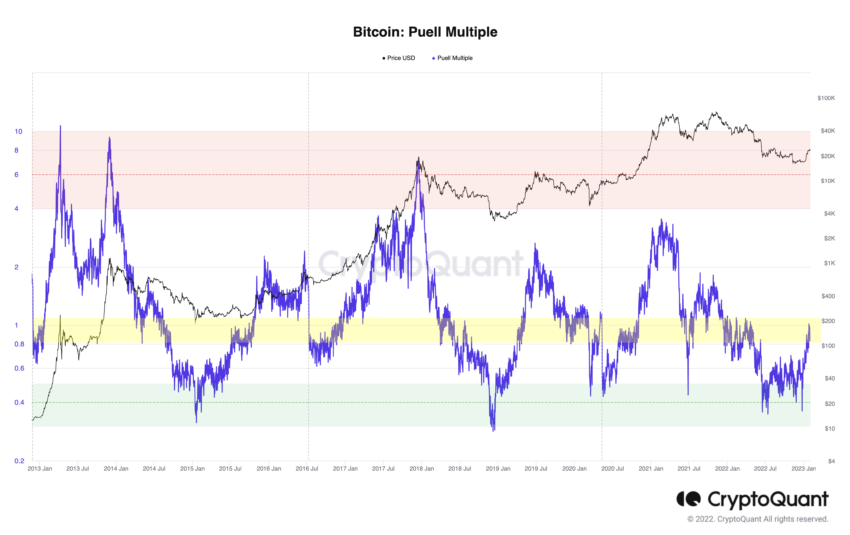

The Puell Numerous is a metric utilized to determine the rate of roi in the cryptocurrency market. It is determined by dividing the overall everyday mining income by the overall everyday mining expenses. A Puell Numerous listed below 0.5 is thought about a perfect purchasing chance for optimum earnings. A Puell Numerous above 1 is thought about an indication, as it might show a market bubble.

The Puell Numerous is likewise a crucial indication to see, presently at 0.99 and dealing with substantial resistance. The perfect purchasing chance for this indication is listed below 0.5, with the top of the variety being 1.08.

Wait or Purchase?

With all 3 of these on-chain indications presently outside the perfect purchasing variety for optimum earnings, traders and financiers deal with a choice. They need to await the indications to return into the perfect purchasing zone or take a threat and purchase on the next breakout with an aggressive earnings technique.

Comprehending these indications and their motions is essential for making educated financial investment choices in the extremely unstable and unforeseeable cryptocurrency market.

Disclaimer

BeInCrypto aims to offer precise and current details, however it will not be accountable for any missing realities or incorrect details. You comply and comprehend that you ought to utilize any of this details at your own danger. Cryptocurrencies are extremely unstable monetary possessions, so research study and make your own monetary choices.