Bitcoin Had a Rough September. Here Are the Secret Metrics to Enjoy Next

Secret Takeaways

Bitcoin’s market price dropped almost 14% in September.

Market belief has actually turned cynical due to the leading crypto’s bad rate efficiency.

On-chain information reveals no considerable indications of build-up yet.

Share this post

Bitcoin will close September at a double-digit loss relative to August. As market belief continues to weaken, the leading cryptocurrency requires to keep a crucial assistance level to prevent a significant correction.

Bitcoin in Threat

Bitcoin is combining around the $19,000 assistance level. Market individuals have actually born in mind of the leading crypto’s weak rate action over current weeks.

The marketplace belief towards Bitcoin stays unfavorable. Social information from Santiment reveals a weighted belief rating of -0.69, while talk of Bitcoin on social networks sits listed below 20%, suggesting that interest has actually subsided.

Brian Quinlivan, Director of Marketing at Santiment, kept in mind the pattern in a September 30 wrap-up report, mentioning that “the world stays in a really delicate location, and traders aren’t relying on much of anything to increase at any time quickly.” Crypto has actually suffered along with other risk-on possessions throughout this year in the middle of skyrocketing inflation rates, rates of interest walkings, a worldwide energy crisis, and market fatigue off the back of the 2021 booming market.

The decreasing interest in Bitcoin can likewise be seen from an on-chain viewpoint. According to Glassnode information, the variety of addresses holding a minimum of 1,000 BTC has actually stayed constant at around 2,117 addresses over the previous 3 days, following a sharp 26.75% decrease. This market habits recommends that popular financiers have actually disliked building up more coins.

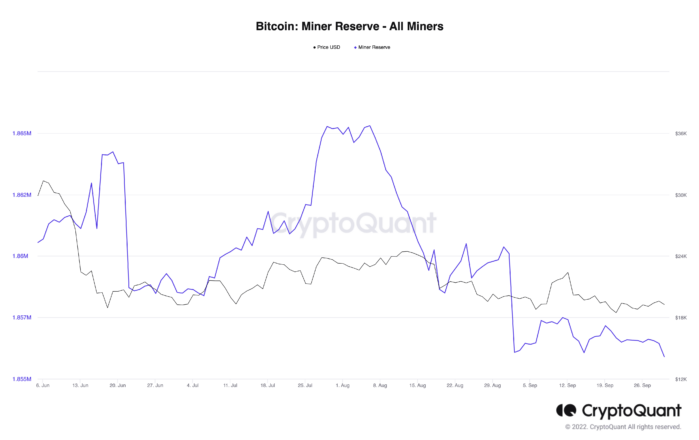

A comparable pattern is playing out with miners. According to CryptoQuant information, Bitcoin miners’ reserves have actually plateaued at 1.86 million tokens, holding around this level for almost a month. The lack of exercise amongst miners follows a substantial selloff in August.

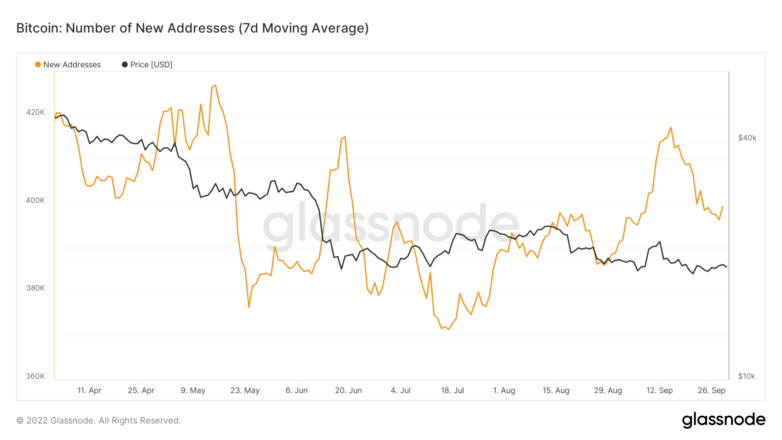

Regardless of the information revealing a bleak outlook for the top crypto, the variety of brand-new everyday addresses developed on the network tips that the leading crypto might publish a turn-around. The Bitcoin network is broadening, revealing an uptick in retail interest given that mid-July. The bullish divergence in between network development and the possession’s rate indicate a possible enhancement in momentum in the future.

If network development strikes a greater high at a seven-day average of more than 417,000 addresses, the bullish story might be verified.

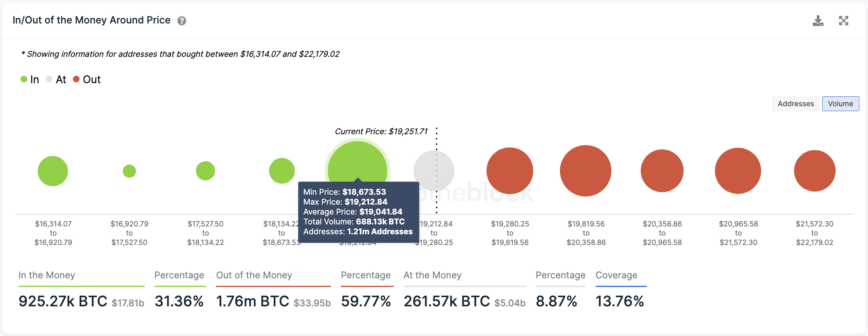

Deal history reveals that BTC developed a crucial assistance level at $19,000, where 1.21 million addresses bought over 688,000 BTC. This need wall need to hold to avoid a high correction. If it stops working to hold this level, a selloff might occur, possibly sending out BTC to $16,000 or lower.

IntoTheBlock’s IOMAP design reveals that Bitcoin deals with numerous locations of resistance ahead. The most significant one sits at $20,000, where 895,000 addresses hold almost 470,000 BTC.

It’s been a rough year for markets, and crypto hasn’t been spared in the fallout. While Bitcoin is now practically a year into a harsh bearish market, a number of indications recommend that the discomfort might not be over. Even as brand-new entrants sign up with the leading crypto’s network, the worldwide macro photo, decreasing belief and miner interest, and current rate action tip that there’s no clear factor for the Bitcoin story to turn bullish anytime quickly.

Disclosure: At the time of composing, the author of this piece owned BTC and ETH. The details consisted of in this piece is for academic functions just and is not financial investment recommendations.

For more crucial market patterns, sign up for our YouTube channel and get weekly updates from our lead bitcoin expert Nathan Batchelor.

Share this post

The details on or accessed through this site is acquired from independent sources our company believe to be precise and trusted, however Decentral Media, Inc. makes no representation or service warranty regarding the timeliness, efficiency, or precision of any details on or accessed through this site. Decentral Media, Inc. is not a financial investment consultant. We do not offer customized financial investment recommendations or other monetary recommendations. The details on this site goes through alter without notification. Some or all of the details on this site might end up being out-of-date, or it might be or end up being insufficient or unreliable. We may, however are not obliged to, upgrade any out-of-date, insufficient, or unreliable details.

You must never ever make a financial investment choice on an ICO, IEO, or other financial investment based upon the details on this site, and you must never ever translate or otherwise depend on any of the details on this site as financial investment recommendations. We highly suggest that you speak with a certified financial investment consultant or other competent monetary expert if you are looking for financial investment recommendations on an ICO, IEO, or other financial investment. We do decline payment in any kind for examining or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or products.

See complete conditions.