BRC-20s Might Be Unregistered Securities

Bitcoin maximalist and financier Michael Saylor has actually alerted about the capacity for BRC-20 tokens to end up being unregistered securities. Nevertheless, Saylor is still normally bullish about their larger adoption. In the middle of a BRC-20 trend that almost crashed a network, an advanced understanding of their usages and abuses is important.

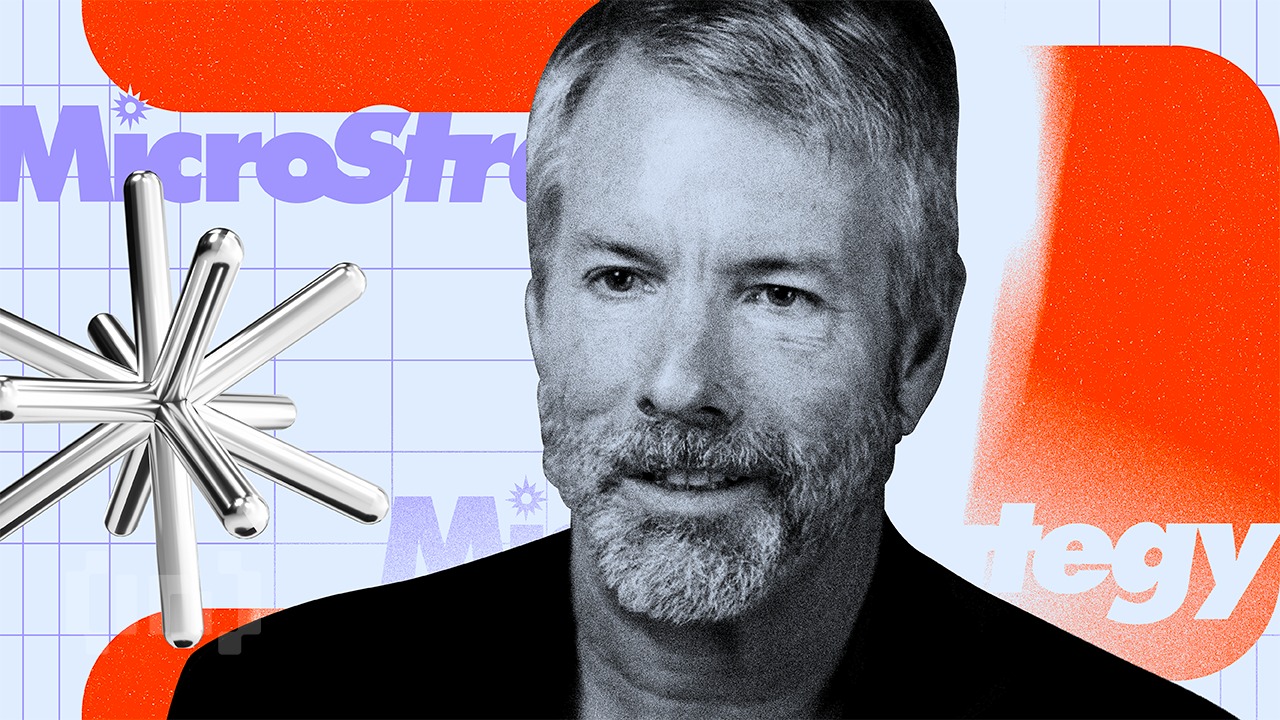

Michael Saylor is the CEO of MicroStrategy and a popular Bitcoin maximalist. He has actually made headings with MicroStrategy’s considerable financial investments in Bitcoin and his consistent defense of the initial cryptocurrency.

Michael Saylor’s Nuanced Take

Although, in a current interview with DeCrypt, Saylor sounded a careful note. He fretted about a few of the possible usages of Bitcoin Ordinals and BRC-20 tokens.

” If BRC-20 tokens are deemed fungible tokens to provide unregistered securities, there’s a great deal of objection to that, due to the fact that it’s dishonest. It’s unlawful. And you can’t blame [the community] for challenging that,” Saylor informed DeCrypt.

Bitcoin Ordinals actively allow the engraving of satoshis (the tiniest Bitcoin systems) with non-financial details, making them comparable to non-fungible tokens (NFTs).

BRC-20 tokens, on the other hand, are a brand-new token requirement on the Bitcoin network. They integrate a particular kind of ingrained text. Functioning as ordinal engravings that develop a set of guidelines and requirements for developing and handling the tokens.

BRC-20s utilize Ordinals, however not all Ordinals are ERC-20s.

BRC-20s Might Be Unregistered Securities

BRC-20 tokens could, in specific cases, represent shares in business or tasks. Nevertheless, their absence of registration with regulators unlocks to possible scams and market adjustment. In addition, this circumstance draws in undesirable attention to the Bitcoin network.

” What if I was utilizing them to tokenize all of the stocks and ETFs trading on NASDAQ so that people can take individual custody of their shares of stock rather of leaving them secured with a central custodian,” Saylor stated. “If it existed that method, then Bitcoiners would like it.”

Nevertheless, Saylor is normally bullish about their development and thinks it can assist drive adoption. “Each time somebody constructs an application that’s cool on Bitcoin, like all the Ordinals and engravings and whatever that are increasing deal charges, it’s a driver,” Saylor informed the PBD Podcast.

” The entire concept of burning a piece of information on the blockchain unlocks to the possibility that I may burn a digital signature, or I may burn a registration, or I may burn a hash of a file,” Saylor stated.

Previously this month, the BRC-20 trend overwhelmed the Bitcoin network. The appeal of Ordinals likewise resulted in Binance stopping BTC withdrawals.

Disclaimer

In adherence to the Trust Task standards, BeInCrypto is devoted to impartial, transparent reporting. This news post intends to supply precise, prompt details. Nevertheless, readers are encouraged to confirm realities separately and seek advice from an expert prior to making any choices based upon this material.