Britain Reveals Prepare For ‘Robust’ Crypto Rules, Launches Assessment– Guideline Bitcoin News

The U.K. has actually revealed “enthusiastic strategies” to “robustly control” different crypto activities, while looking for to secure clients and grow its economy. In the next 3 months, British authorities will accept public feedback on the brand-new regulative propositions developed to govern digital properties like standard financing.

British Federal Government Sets Out to Control Crypto Market, Stays Dedicated to Development

The executive power in London has actually revealed strategies to control a vast array of crypto-related activities through brand-new guidelines for the young market that will follow Britain’s policies for the standard monetary sector.

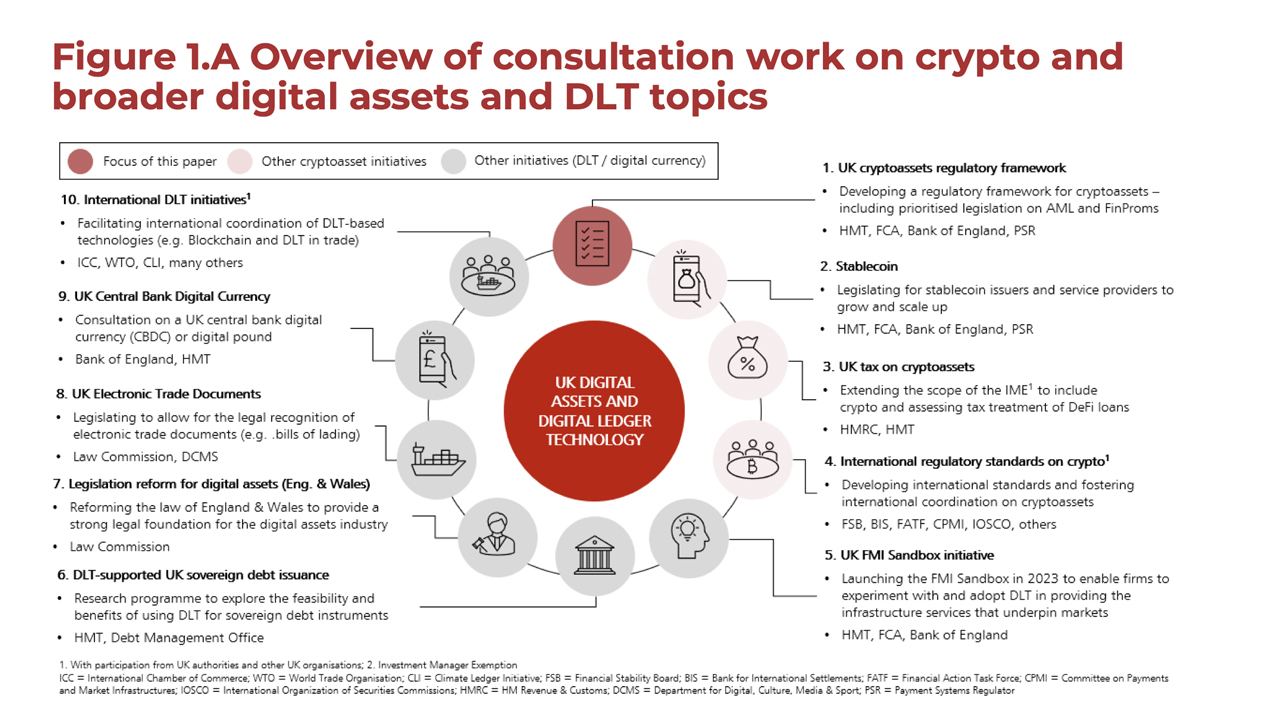

A public assessment on the propositions has actually been released and will continue till completion of April. In the released paper, the U.K. Treasury declares its belief that “crypto innovations can have an extensive effect throughout monetary services.” The file supplies an introduction of the assessment work ahead.

The British federal government likewise insisted its technique to policy “alleviates the most considerable threats, while utilizing the benefits of crypto innovations” and revealed wish to make it possible for the crypto market to broaden, invest, and produce tasks. Economic Secretary to the Treasury Andrew Griffith highlighted:

We stay unfaltering in our dedication to grow the economy and make it possible for technological modification and development– and this consists of crypto-asset innovation. However we should likewise secure customers who are welcoming this brand-new innovation.

The draft guidelines intend to make sure that crypto exchanges “have reasonable and robust requirements.” They will be accountable for “specifying the comprehensive material requirements for admission and disclosure files,” a statement exposed on Wednesday.

Authorities likewise suggested they wish to enhance the guidelines for intermediaries and custodians that help with cryptocurrency deals and shop consumer digital properties. They think this would assist to develop a “world-first program” for crypto financing.

The relocation can be found in the after-effects of numerous prominent failures that shook the crypto area, consisting of the collapse of significant crypto exchange FTX. The British federal government has formerly stated that it means to embrace policies that would avoid market abuses.

Bulk of Crypto Possession Business in the UK Fail to Get Regulative Approval

The regulative propositions follow recently’s statement by the U.K.’s Financial Conduct Authority (FCA) that the majority of entities that wish to work with crypto properties in Terrific Britain, 85% of all candidates, have actually stopped working to persuade regulators they can satisfy the nation’s minimum anti-money laundering (AML) requirements.

The regulator stated it had actually recognized considerable failures in spheres such as due diligence, danger evaluation, and deal tracking. “In a lot of cases, essential workers did not have proper understanding, abilities and experience to perform assigned functions and control threats efficiently,” the FCA stated.

On The Other Hand, the Treasury Committee at your house of Commons is still checking out the possible risks and chances connected with crypto properties and the requirement for policy. “We remain in the middle of a query into crypto policy and these stats have not disabused us of the impression that parts of this market are a ‘Wild West,'” Harriett Baldwin, chair of the choose committee, was estimated as specifying.

What impact do you believe the upcoming U.K. guidelines will have on the advancement of the nation’s crypto market? Share your expectations in the remarks area listed below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This post is for informative functions just. It is not a direct deal or solicitation of a deal to purchase or offer, or a suggestion or recommendation of any items, services, or business. Bitcoin.com does not offer financial investment, tax, legal, or accounting recommendations. Neither the business nor the author is accountable, straight or indirectly, for any damage or loss triggered or declared to be brought on by or in connection with using or dependence on any material, items or services discussed in this post.