Covered Bitcoin Job Sees 18% Redemption of Distributing Supply in 54 Days– Altcoins Bitcoin News

Data reveal throughout 54 days, the variety of covered bitcoin (WBTC) hosted on the Ethereum network has actually reduced by 40,156. This relates to a more than 18% redemption of the distributing supply of WBTC because Nov. 27, 2022.

WBTC Stays Largest Operation in Regards To Bitcoin Custody Regardless Of Current Redemptions

The Bitgo-backed Covered Bitcoin (WBTC) job has actually been formally in operation because completion of January 2019 and has actually grown considerably because its launch. At the time of composing, it is the biggest operation in regards to the variety of bitcoin (BTC) custodied to back the WBTC token worth.

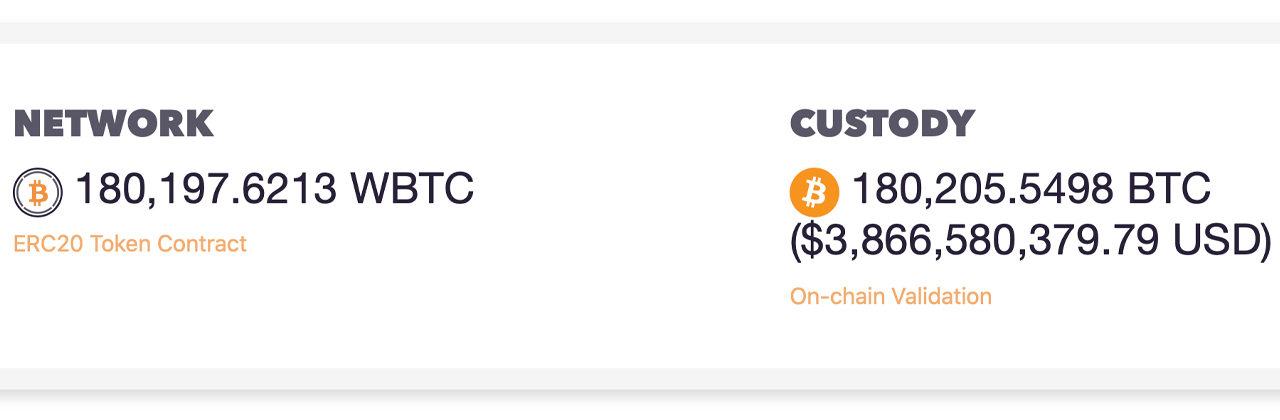

On January 20, 2023, WBTC is the 19th biggest crypto property by market capitalization, valued at $21,278 per system. WBTC’s market appraisal on Friday afternoon Eastern Time was around $3.8 billion. According to the job’s site and openness control panel, at 3:00 p.m. Eastern Time on Jan. 20, 2023, there were roughly 180,197 WBTC in blood circulation on the Ethereum chain.

The job likewise handles 99.89 WBTC which is hosted on the Tron blockchain network. The stash of ERC20-based WBTC tokens is significantly less than it was 54 days back on Nov. 27, 2022, when 220,353 WBTC ($ 16.4 K per BTC) was distributing on the Ethereum blockchain network. 10 months prior, on Feb. 26, 2022, the variety of WBTC in blood circulation was roughly 262,662 ($ 39.4 K per BTC).

That implies over the last 10 months, 31.39% of the WBTC in blood circulation was gotten rid of from the total supply. Over half of that portion, or 18.22%, of the WBTC supply was redeemed over the last 54 days, or 40,156 WBTC overall, because Nov. 27, 2022.

While WBTC is the biggest covered variation of bitcoin, Lido’s staking token STETH, a derivative of Ethereum, is the biggest artificial variation of a leading crypto property in regards to market capitalization. STETH, nevertheless, does run in a different way than Bitgo’s management of merely holding the BTC for the provided quantity released.

While there’s 180,197 WBTC in blood circulation today, there’s roughly 180,205 BTC backing the WBTC supply in Bitgo’s custody, according to the site’s control panel. The products of covered or artificial BTC tokens have actually followed the exact same pattern as stablecoins, as the stablecoin economy has actually seen billions in redemptions over the in 2015.

What do you think of the WBTC job seeing an 18% redemption of the distributing supply over the last 54 days? Share your ideas about this topic in the remarks area listed below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This post is for educational functions just. It is not a direct deal or solicitation of a deal to purchase or offer, or a suggestion or recommendation of any items, services, or business. Bitcoin.com does not supply financial investment, tax, legal, or accounting guidance. Neither the business nor the author is accountable, straight or indirectly, for any damage or loss triggered or declared to be triggered by or in connection with using or dependence on any material, products or services pointed out in this post.