Development Towards Bitcoin’s Halving Is 60% Total, Block Times Suggest Decrease Might Occur Next Year– Mining Bitcoin News

According to countdown data based upon the typical block generation time of around 10 minutes, development towards the next Bitcoin block benefit halving has actually gone beyond 60%. Nevertheless, while a lot of halving countdown clocks utilize the ten-minute average, the countdown leveraging the most existing block periods of around 7:65 minutes reveals the halving might take place in 2023.

Faster Block Intervals Suggest Bitcoin Halving Might Occur in 2023

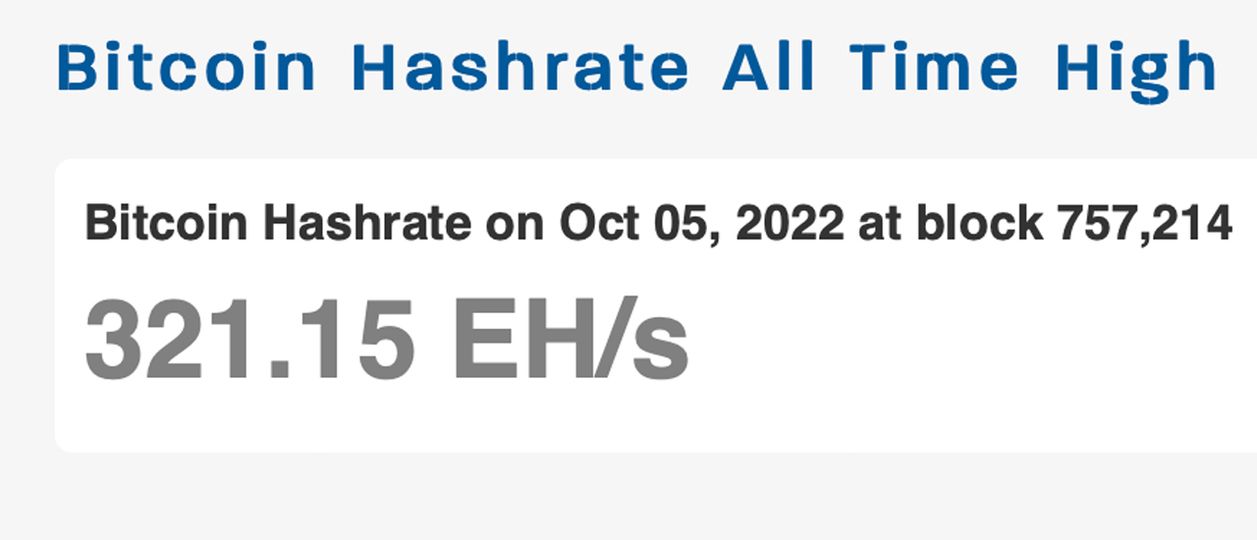

Simply just recently, at block height 757,214, mined on October 5, 2022, Bitcoin’s overall hashrate tapped an all-time high (ATH) at 321.15 exahash per 2nd (EH/s). Recently, block periods have actually been faster than typical and well under the ten-minute average.

The speed at which the 2,016 blocks are discovered in between problem modifications identifies the problem and existing block periods recommend a big problem dive remains in the cards. Now, prior to the next problem increase, the hashrate has actually continued to stay strong and block times at the time of composing are around 7:65 minutes.

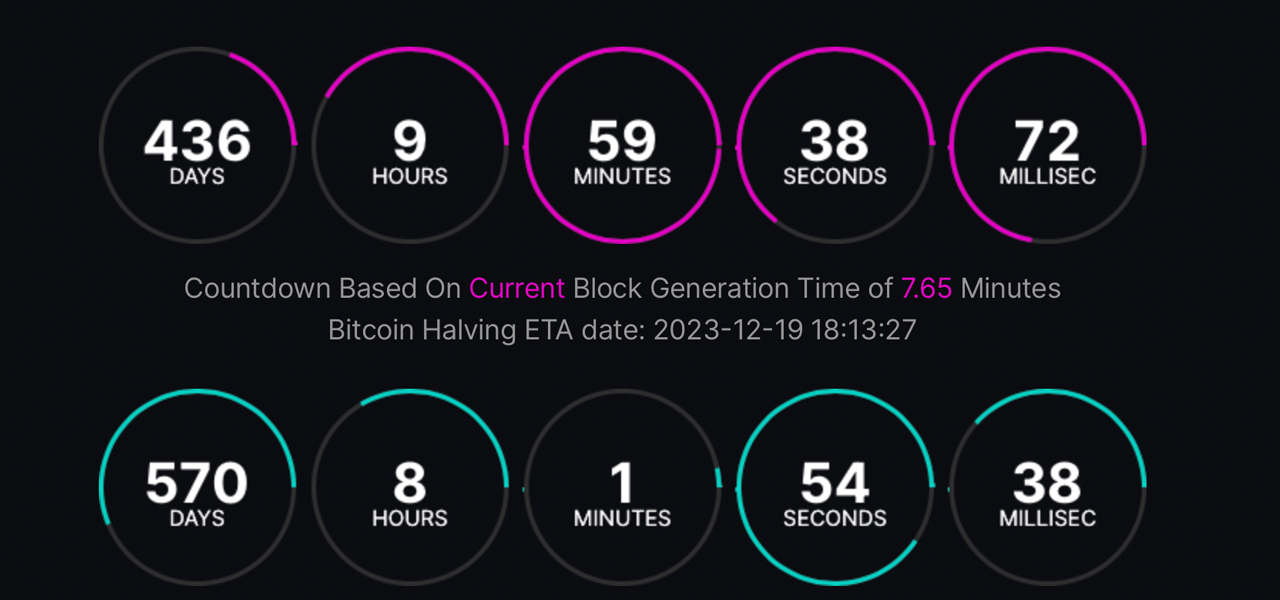

The next mining problem retarget is arranged to take place on or around October 10, 2022. If block times stay faster than typical even after the retarget, the procedure’s block benefit halving might effectively take place in 2023. Stats from bitcoinsensus.com suggest that at 7:65 minutes per block period, the halving might occur on or around December 19, 2023.

Bitcoinsensus.com even more reveals the halving time based upon the typical ten-minute guideline which reveals the halving will take place on May 1, 2024. A lot of countdown calculators use the typical ten-minute guideline, and other information points recommend the halving might take place on April 20, 2024.

In either case, the development towards the next halving is still more than 60% total, and when it happens, bitcoin miner benefits will be lowered from 6.25 BTC to 3.125 BTC post halving. Regardless of the high speed now, miners might quickly decrease after the significant problem boost on October 10 is taped and if BTC rates stay low.

This, in turn, would press the halving go back to the 2024 variety and after all, there’s still well over a year’s worth of BTC block aids to mine. A lot can alter. According to a current article from Blocksbridge Consulting, the problem modification and low cost variety might provide bitcoin miners a headache from loss of earnings.

” Bitcoin’s day-to-day mining earnings per PH/s is presently around $80. If the problem increases 13% on Monday and bitcoin’s cost remain at $19.5 K, the day-to-day earnings would reduce to $70 per (petahash) PH/s,” Blocksbridge Consulting’s Miner Weekly concern # 17 notes. “That would trigger mining business to mine at all-time low profits daily, even lower than what we saw throughout the summer season following the May 2020 halving.”

The article includes:

Unless bitcoin’s cost breaks the $20,000 barrier, those who utilize older-generation makers or have puffed up mining operations will deal with an even harder time ahead.

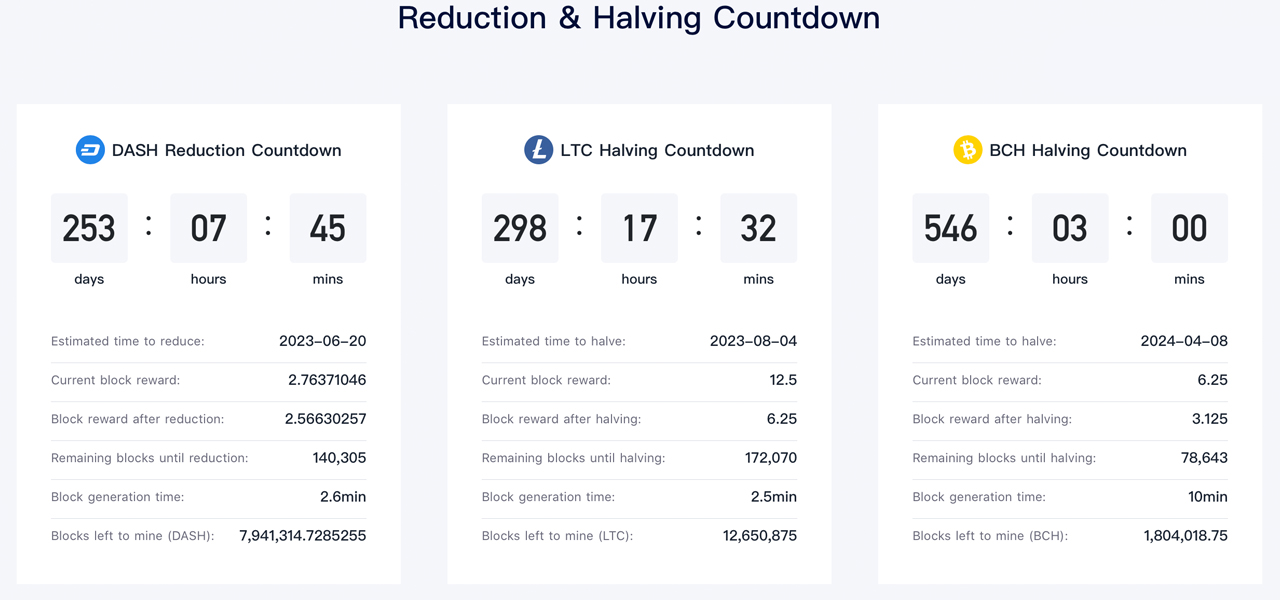

Viabtc’s Viawallet halving metrics reveal that 8 blockchains are anticipated to see benefit halvings or what’s called “benefit decreases.” Dash anticipates a benefit decrease on June 20, 2023, as benefits will avoid 2.76 DASH to 2.56 DASH. Other decrease occasions and benefit halvings will come from blockchains that consist of BCH, BSV, LTC, AND SO ON, ZEC, and ZEN.

What do you consider the Bitcoin network’s development towards the next halving surpassing 60%? Let us understand what you consider this topic in the remarks area listed below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This short article is for informative functions just. It is not a direct deal or solicitation of a deal to purchase or offer, or a suggestion or recommendation of any items, services, or business. Bitcoin.com does not supply financial investment, tax, legal, or accounting guidance. Neither the business nor the author is accountable, straight or indirectly, for any damage or loss triggered or declared to be triggered by or in connection with making use of or dependence on any material, items or services discussed in this short article.