Ethereum cost retreats as the put/call ratio edges upwards

The incredible crypto return has actually stalled following a series of weak business revenues from the United Statistics. Ethereum drew back to $1,500 on Thursday as information revealed that the put/call ratio was heading greater. It has actually fallen by over 5.90% from the acme this year.

Put and call ratio slips

The alternatives market is a crucial one throughout all property classes, consisting of cryptocurrencies, stocks, and products. It includes putting put-and-call trades on a property. A call provides the trader the right to purchase a property while a put provides the right to offer.

The put to call ratio is an important tool that traders and financiers utilize to anticipate whether a property will increase or not. That is why it is a fundamental part of the worry and greed index.

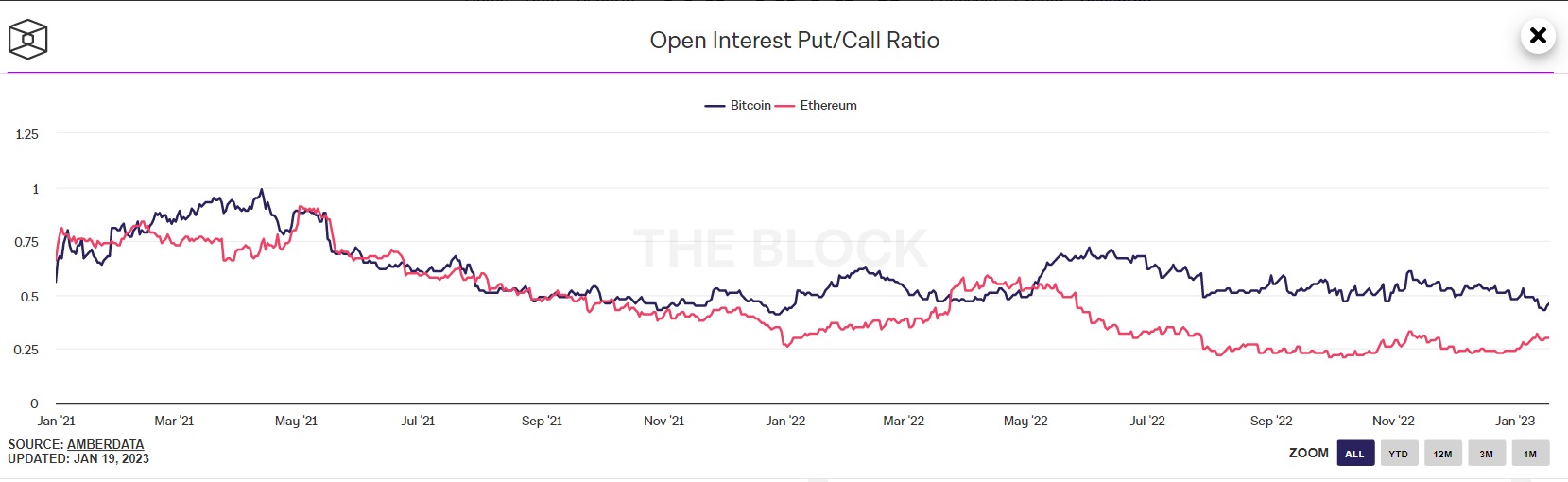

Information assembled by The Block reveals that Ethereum’s put/call ratio has actually edged up a little in the previous couple of days. It has actually increased from 0.24 on January 4 to a high of 0.3. Historically, a lower ratio is typically chosen because it suggests that there are more purchasers in the alternatives market. Still, it must be kept in mind that The Block’s information comes just from Deribit and does not consist of other exchanges.

On the other hand, another information by CoinGlass reveals that the variety of brief liquidations in essential exchanges increased to the acme in months on January 15. Liquidations have actually continued however at a slower rate ever since. Nevertheless, at the very same time, long liquidations have actually been increasing. On Wednesday, they increased to the greatest level because December 16 of in 2015.

The primary factors for these liquidations is the weak monetary outcomes by business like Goldman Sachs and JP Morgan. A few of these companies have actually alerted about an economic crisis and revealed substantial task cuts. Microsoft is laying off over 10,000 individuals.

Ethereum cost projection

ETH/USD chart by TradingView

Ethereum has actually stumbled as put and call ratio and long liquidations increase. This stumbling took place as the coin reached a high of $1,612, the acme because November. It has actually moved a little listed below the coming down trendline displayed in purple.

At the very same time, it has actually had a hard time moving above the bottom line at $1,667, the acme on November 4. For that reason, I still think that the outlook for Ethereum is still bullish, with the next bottom line to enjoy being at $2,000 as I composed in this short article.

How to purchase Ethereum

Binance

Binance is among the biggest cryptocurrency exchanges worldwide. It is much better fit to more knowledgeable financiers and it uses a a great deal of cryptocurrencies to select from, at over 600.

Binance is likewise understood for having low trading costs and a multiple of trading alternatives that its users can take advantage of, such as; peer-to-peer trading, margin trading and area trading.

Buy ETH with Binance today.

FP Markets

FP Markets integrates metals, indices connection and acclaimed execution speed with institutional-grade liquidity to offer traders regularly tighter spreads and unrivaled trading conditions. FP Markets uses Forex, Equities, Products, Cryptocurrency, Futures and Index CFDs all from one account.

Buy ETH with FP Markets today.

Disclaimer