Ethereum (ETH) Supply Down 0.285% in 240 Days Post-Merge

Today marks 240 days because an occasion the Ethereum neighborhood has actually familiarized as “the combine.” And its impacts on the overall ETH supply are clear.

Probably the most substantial upgrade in its history, the combine saw the Ethereum network shift from an Evidence of Work (PoW) agreement system to one based upon Evidence of Stake (PoS). Now, 8 months on from the critical occasion, the long-lasting effects of the combine are emerging.

ETH Supply Decreases

According to the Ethereum analytics control panel ultrasound.money, almost 650,000 ETH has actually been burned because the combine. In the exact same time period, simply under 424,000 brand-new ETH have actually been minted. The outcome is a net supply modification of around -226,000 ETH.

As a portion of the overall supply, the numbers represent a decline of 0.213% or 0.285% annualized.

Had the combine not taken place, ultrasound.money approximates that the overall ETH supply would have increased at a rate of 3.244% each year in the exact same duration.

Long-lasting Ether holders will likely invite the news. After years of increasing supply, the greater burn rate in the previous 240 days represents a deflationary trajectory. This might reward financiers by pressing the rate of ETH up.

Driving Ethereum’s post-merge supply characteristics is a technical modification that saw the network change miners with validators. Most importantly, validator benefits are considerably less than the mining benefits provided under the PoW system.

This is since running a verifying node is not as financially extreme as running a mining node.

According to the Ethereum Structure, prior to transitioning to PoS, miners were provided around 13,000 ETH a day. Given that the combine, nevertheless, the only fresh Ether provided is the approximately 1,700 ETH a day that goes to stakers.

In addition to the lower benefit system enacted by PoS rather than PoW agreement, greater burn rates are likewise driving ETH deflation.

Developing Ethereum Mechanics

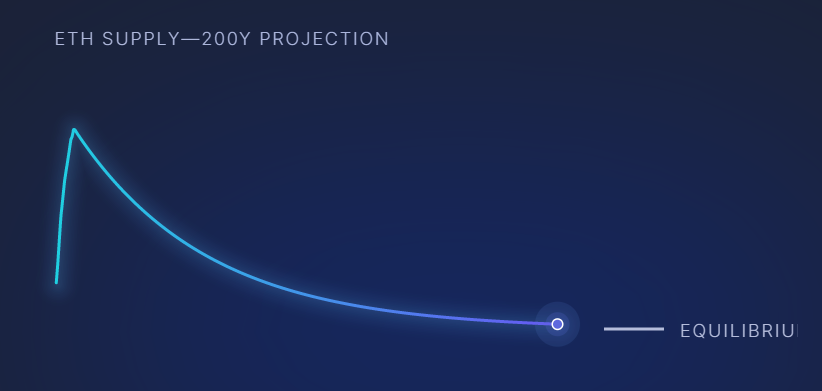

In the months because the combine, the characteristics of PoS-era ETH supply have actually entered sharper focus. However the concern of the length of time the network can keep deflationary economics stays.

According to existing presumptions, then issuance as a percentage of the distributing supply will increase till it equates to the rate of Ether burned. This will ultimately result in a distributing supply balance where issuance equates to burn rate.

Based upon modern typical staking benefits and burn rates, the production and damage of ETH are set to assemble at around 709,000 ETH each year.

Mathematical designs have actually put the overall distributing supply at balance as in between 27.3 and 49.5 million ETH.

Thinking about today’s supply of over 120 million ETH, if existing patterns continue the overall supply will continue diminishing. Under the above presumptions concerning balance, the deflationary trajectory will hence continue for several years.

Disclaimer

In adherence to the Trust Task standards, BeInCrypto is devoted to objective, transparent reporting. This news post intends to supply precise, prompt info. Nevertheless, readers are recommended to confirm realities separately and talk to an expert prior to making any choices based upon this material.