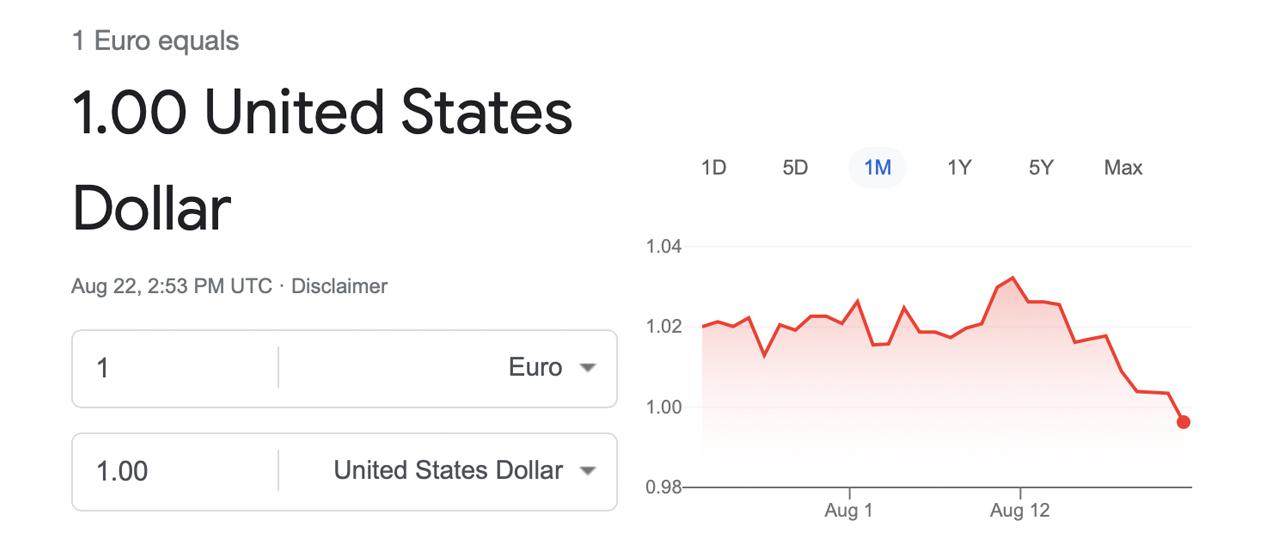

EUR Drops Listed Below USD for the 2nd Time in twenty years, Greenback’s Strength Causes Largest Weekly Increase Given That March 2020– Financing Bitcoin News

The U.S. dollar has actually been really strong compared to a myriad of fiat currencies around the world and today, the euro dropped listed below the USD for the 2nd time in twenty years after fulfilling parity with the dollar in mid-July. The dollar’s current brawniness has actually led to the biggest weekly increase because March 2020, according to Product Futures Trading Commission (CFTC) information.

United States Dollar Rises, Euro Falters — Stocks, Rare-earth Elements, and Cryptos Drop Lower

On Monday, the Dow Jones Industrial Average dropped 400 points as inflation worries continue to grip Wall Street. The 4 significant stock indexes– NYSE, Nasdaq, Dow, and S&P 500– all began the early morning (EST) in red compared to the gains tape-recorded recently. Gold and silver markets have actually felt down pressure today as both rare-earth elements are down in worth on Monday early morning. In addition, the international cryptocurrency market capitalization is down 1.4% today too, and hovering simply above the $1 trillion mark.

The start of the week has actually seen the euro fail listed below the U.S. dollar for the 2nd time in twenty years. At the time of composing, the 2 fiat currencies are trading for the specific very same quantity of worth however the euro slipped down to $0.99 early Monday early morning (EST). The euro dropping listed below and conference parity with the USD likewise happened on July 12, 2022, when the USD increased to 1.0098. On Monday, August 22, the dollar index (DXY) continues to reveal strength at 108.711.

Reuters reports that the euro’s drop on August 22 is because of an energy and petroleum crisis Europe has actually been handling because the start of the Ukraine-Russia war. On the other hand, Reuters likewise crunched information coming from the CFTC and the numbers reveal the “U.S. dollar net longs struck greatest because early March 2020.” Numerous think as long as the war continues and the Federal Reserve continues rate of interest walkings and financial tightening up, the greenback will stay robust.

China’s Realty Chaos Triggers Reserve Bank to Slash Rates Amidst United States Federal Funds Rate Walking Worries

In addition to the robust dollar and the war in Europe, China’s economy has actually been handling a significant property crisis. Previously today the mega theater chain in China Cineworld, has actually revealed indications of monetary weak point and it was hypothesized that the business was near personal bankruptcy. On Monday, China’s reserve bank cut the benchmark financing rate and the home mortgage recommendation rate to relieve the economy’s pressures.

With the strong dollar, Wall Street’s primary indexes in the red, gold and silver down, and the crypto economy going to pieces, reports suggest that the worry comes from the Federal Reserve’s next rate walking. Nevertheless, after the U.S. reserve bank raised the federal funds rate by 75 basis points (bps) last month, approximates collected by Reuters state the Fed might be softer this month.

” The U.S. Federal Reserve will raise rates by 50 basis points in September in the middle of expectations inflation has actually peaked and growing economic downturn concerns, according to financial experts in a Reuters survey,” the report detailed.

What do you think of the U.S. dollar’s strength and the euro dropping listed below the USD’s worth? What do you think of the macroeconomic problems afflicting today’s monetary markets? Let us understand what you think of this topic in the remarks area listed below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This short article is for educational functions just. It is not a direct deal or solicitation of a deal to purchase or offer, or a suggestion or recommendation of any items, services, or business. Bitcoin.com does not supply financial investment, tax, legal, or accounting recommendations. Neither the business nor the author is accountable, straight or indirectly, for any damage or loss triggered or declared to be triggered by or in connection with making use of or dependence on any material, items or services discussed in this short article.