Fed Ran Banks Despair, Can Bitcoin Come to Rescue?

Bank-induced monetary chaos has actually activated a selection of responses signifying diminished rely on central banking bodies. Therefore, generating a “TradFi winter season.” Can crypto like Bitcoin increase to the celebration in the middle of disheartening actions from regulators?

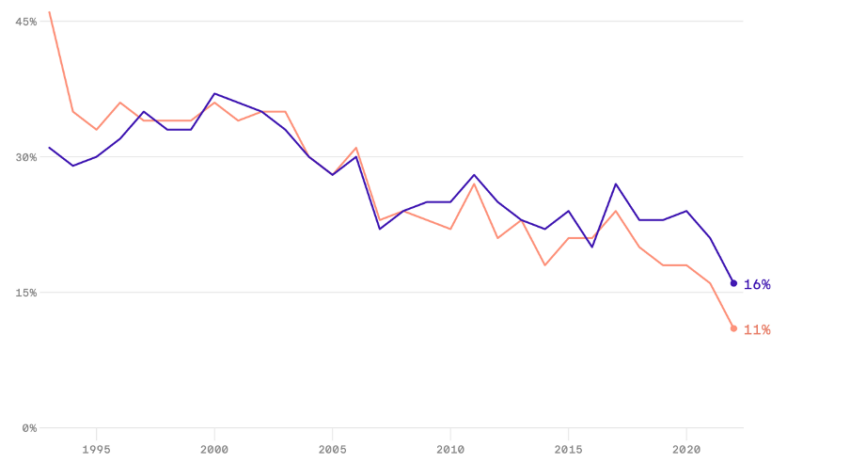

The standard financing (TradFi) market has actually dealt with obstacles just recently, consisting of increased guideline, competitors from fintech companies, and altering customer choices. Among the market’s greatest issues is the possibility of an abrupt monetary crisis, comparable to the 2008 international crisis. Banking organizations have actually struggled to restore trust following the excellent economic crisis.

This issue has actually been magnified by the COVID-19 pandemic, which exposed weak points in the monetary system and increased the probability of a monetary fiasco.

Among the most considerable dangers dealing with the TradFi market is the possibility of a bank run. A bank run takes place when lots of depositors withdraw their funds at the same time, triggering the bank to lack money and possibly resulting in its collapse. Numerous aspects, consisting of reports of monetary instability, issues about the security of deposits, and modifications in federal government policies, can activate bank runs.

Deep Unpredictability

The threat of bank runs has actually increased over the last few years due to numerous aspects. One is the increased interconnectedness of the international monetary system. Banks are now more interconnected than ever, with complicated monetary instruments connecting them in a web of monetary responsibilities. This indicates that if one bank stops working, it can activate a waterfall of failures throughout the system.

Another aspect that has actually increased the threat of bank runs is the development of shadow banking. Shadow banking describes supplying banking services beyond standard banking channels, such as through hedge funds, cash market funds, and other non-bank banks. Shadow banking is typically less regulated than standard banking and can be more susceptible to monetary shocks.

The COVID-19 pandemic even more upped the threat of bank runs by exposing weak points in the monetary system. Numerous federal governments executed lockdowns and other steps that seriously impacted the economy throughout the pandemic. This caused a sharp decrease in financial activity, which lowered the worth of lots of monetary properties.

Immense Pressure

The decrease in possession worths has actually put pressure on banks and other banks, as they are typically greatly purchased these properties. This has actually increased the threat of bank failures and made bank runs most likely. In addition, the pandemic caused a boost in joblessness, which lowered the capability of customers to repay their financial obligations. Of late, savings account holders of all sizes are now handling an unique threat after the prominent collapse of Silicon Valley Bank (SVB).

This has actually put more pressure on the monetary system and increased the threat of financial instability. Generally, the monetary market stays greatly managed and centralized, with banks and other organizations serving as intermediaries in between consumers and monetary markets. Nevertheless, over the last few years, decentralized financing (DeFi) has actually ended up being progressively popular with the introduction of blockchain innovation and cryptocurrencies. DeFi is developed on a decentralized facilities that enables peer-to-peer deals without intermediaries.

While DeFi has actually produced numerous advantages, such as increased openness, ease of access, and lowered expenses, it has actually likewise been related to dangers such as cost volatility, frauds, and hacks. Some argue that standard financing is embracing a few of these unfavorable elements of DeFi, resulting in a “TradFi winter season.”

TradFi Winter Season Is Bad News

The previous Coinbase CTO Balaji Srinivasan tweeted a report from the research study arm of New York-based AllianceBernstein. Herein, Srinivasan raised warnings around banks, calling out the market.

” Tradfi is handling a few of the worst elements of Defi. I call this Tradfi winter season.”

Drawing a couple of parallels, he slammed regulators for not notifying users of a possible bank failure. He likewise kept in mind the nontransparent reporting nature of banking organizations:

” Previous to the printing, banks utilized accounting techniques to deceive themselves and others into believing they have liquid properties to satisfy withdrawals. It’s Uncle Sam Bankman Fried.”

By the time the news gets aired by a reputed reporting company, “it’s typically far too late,” he included. These circumstances have actually caused a systemic loss of rely on western banking, comparable to the loss of trust in western media.

In conclusion, the previous Coinbase executive called it “Low trust banking, low trust society.”

A Couple Of Alternatives

Individuals now recognize the threats of hyper-speed bank runs that can be amplified by social networks and instantaneous payment systems. The Federal Reserve wants to action in and supply liquidity to struggling banks, however that comes at an expense. Ergo, depositors have great factor to try to find other alternatives, thus reducing monetary intricacy to the degree possible.

Can crypto such as Bitcoin assist? The specific niche yet growing possession class has actually seen a massive rise in its worth because its creation. Bitcoin and other cryptocurrencies have the possible to resolve a few of the counterparty runs the risk of that bank consumers might deal with. Among the advantages of Bitcoin is that it enables peer-to-peer deals without the requirement for a relied on intermediary such as a bank.

This indicates that users can negotiate straight with each other, which can decrease the counterparty threat related to standard banking deals. However once again, crypto is still a brand-new face in this video game. The report states:

” The simpleness of crypto as digital bearer properties fixes for the instant counter-party dangers that bank consumers are handling, however consumers likewise need stability of worth. And hence, Bitcoin, as a digital bearer possession, might not instantly interest consumers who see stability in small USD terms.”

Barriers on the Crypto Course

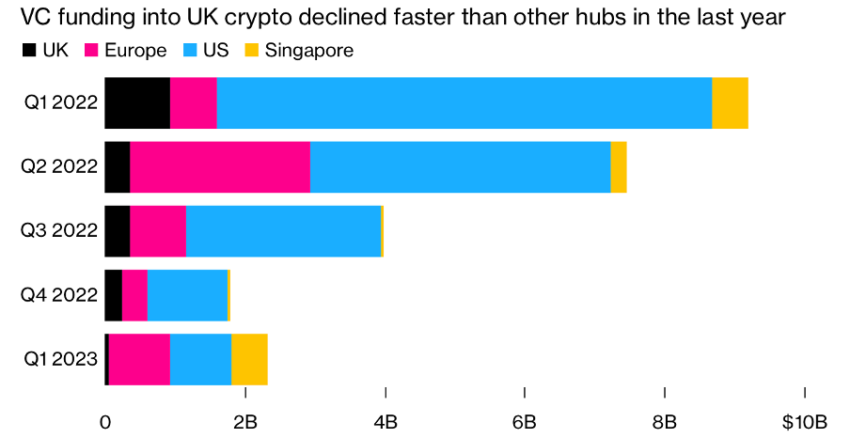

Bitcoin, or crypto’s capacity in basic, is tremendous. However the course to reach its capacity has plenty of barriers. Regulators around the world have actually taken instant actions to neglect crypto. In March, the White Home called out crypto for having no basic worth. Just recently, the UK federal government carried out steps to dissuade crypto development in the area.

Crypto business are normally based on myriad limitations and guidelines that differ by jurisdiction. Some conditions that crypto business might deal with consist of the following:

Licensing requirements: In lots of jurisdictions, crypto business need to acquire a license to run as a cash transmitter or digital possession exchange.

Anti-money laundering (AML) and Know Your Consumer (KYC) requirements: Crypto business need to adhere to AML and KYC guidelines, consisting of identity confirmation, deal tracking, and reporting suspicious activity.

Capital requirements: Some jurisdictions might need crypto business to keep a particular quantity of capital to run.

Tax: Crypto business might go through tax on their revenues and might require to report their deals to tax authorities.

Security and personal privacy requirements: Crypto business need to secure user information and avoid unapproved system gain access to.

Failure to adhere to these limitations and guidelines can lead to charges, fines, or criminal charges. In addition, some crypto business might deal with extra obstacles, such as trouble acquiring banking services or having their accounts frozen by banks due to viewed dangers related to the market.

The documentation concern can likewise be considerable, especially for business that run throughout numerous jurisdictions or that provide a large range of services.

Disclaimer

Following the Trust Job standards, this function post provides viewpoints and viewpoints from market professionals or people. BeInCrypto is committed to transparent reporting, however the views revealed in this post do not always show those of BeInCrypto or its personnel. Readers ought to validate info separately and seek advice from an expert prior to making choices based upon this material.