SSV Network rate types 2 exceptionally bearish patterns

SSV Network is a fast-growing supplier of liquid staking facilities.

The designers released a $50 million environment development fund.

It has actually formed an increasing expanding wedge and a bearish engulfing pattern.

Liquid staking is succeeding as financiers wait on the upcoming Ethereum’s Shanghai upgrade. Lido DAO, the most significant liquid staking supplier, has actually grown to end up being the most significant DeFi supplier on the planet. And SSV, a leading liquid staking facilities supplier, has actually seen its token grow by more than 91% this year.

SSV releases environment fund

SSV Network revealed that it was releasing a brand-new $50 million environment fund in a quote to grow its environment. For beginners, SSV does not use liquid staking itself. Rather, it partners with staking service providers like Lido to use a dispersed validator innovation (DLT) option. By so doing, the majority of designers can concentrate on what they do best.

SSV Network stated that the fund will go to designers dealing with the DVT innovation. It comes a year after the designers released a $3 million fund. It has actually dispersed a few of those funds to business like Ankr, Stader, and Moonstake. SSV likewise designated $10 million in 2022 as we composed here. In a declaration, the co-lead of SSV network stated:

” Dispersing Ethereum’s security layer has actually never ever been more crucial. The procedure is presently protected by a little group of business that, when created, manage the whole Blockchain. DVT’s objective is to disperse Ethereum’s security by providing fast and simple access to an open-source public great.”

The significant driver for the SSV token rate will be the upcoming Shanghai upgrade that will let Ethereum holders have the ability to withdraw their staked coins. Another driver for the token will be SSV’s mainnet launch which will occur in the next couple of months. Its testnet is currently up and running. It has 763 operators and 5,307 validators with 168,824 ETH staked. At the existing rate, the quantity deserves over $260 million.

SSV crypto rate projection

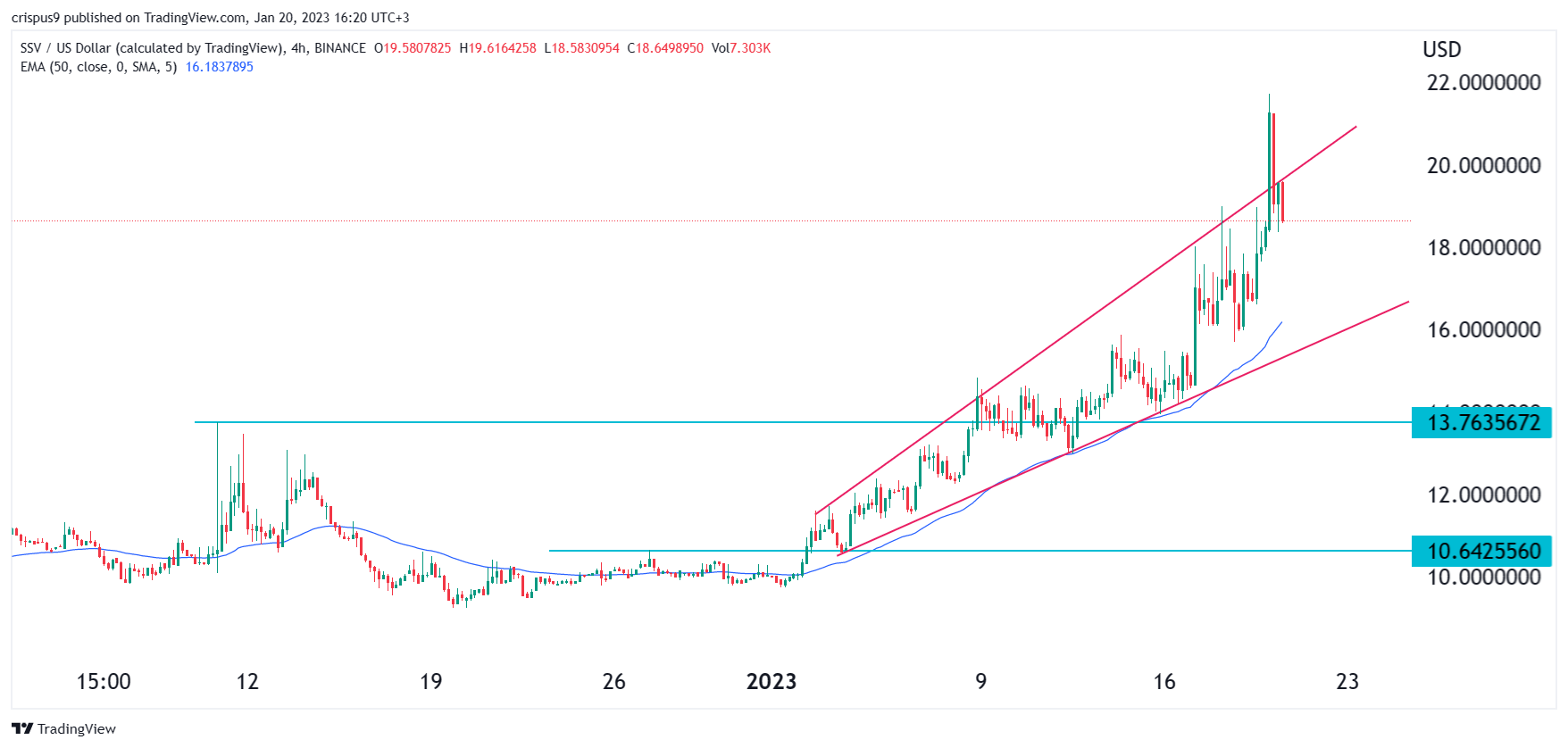

SSV chart by TradingView

The 4H chart reveals that the SSV Network rate has actually remained in a consistent bullish pattern in the previous couple of months. Nevertheless, a closer appearance reveals that a number of bearish patterns have actually begun forming. The token has actually formed a bearish engulfing pattern, which is typically an indication. Even more, the token has actually formed a rising expanding wedge pattern. In rate action analysis, this pattern is likewise a bearish indication.

For that reason, the outlook for SSV crypto rate is bearish, with the next level to see will be the lower side of the rising wedge at $16. The pattern invalidation point for this trade will be at today’s high of $21.67.