Coinbase ends Japan operations, why is share rate still up 50% in 2 weeks?

Secret Takeaways

Coinbase is stopping all operations in Japan, mentioning “market conditions”.

Recently it cut 20% of its labor force, having actually currently cut 18% last June.

Stock rate is up almost 50% on the year in the middle of crypto rally, however is still 85% off its peak.

Issues are aplenty at the business, while CEO Armstrong offered 2% of his stake in October.

Coinbase has actually remained in a world of discomfort just recently.

Simply recently, the exchange revealed it was laying off 20% of its labor force, having actually currently cut 18% last June. I composed a piece evaluating what this suggested for the business, which was trading at a market cap listed below $10 billion, 90% below the rate at which it went public in April 2021.

This followed CEO Brian Armstrong unloaded 2% of his stake in the business in October, after which I composed a deep dive evaluating what all of it suggested for a business that has actually been deemed the torch-bearer to bring crypto into mainstream circles at last following its prominent drifting on the Nasdaq.

However today, more problem came. The exchange revealed it is stopping all operations in Japan, mentioning “market conditions”.

Coinbase stock rate on the up

Regardless of the attack of problem, Coinbase’s share rate has actually been a huge winner in the early weeks of 2023, up 48% in simply 18 days.

This comes in the middle of the most significant crypto rally in 9 months, which has actually seen costs rise throughout the board. While the bounceback in Coinbase’s share rate is terrific news for financiers, it likewise paradoxically summarize precisely what the issue is– Coinbase’s connection to the crypto market.

There are couple of things more unpredictable than crypto, so it is bad news to be connected at the hip to its rate action. However Coinbase’s efficiency depends on the crypto market since as the rate falls, deal volumes and interest in the market, and by extension Coinbase, drops.

Throughout the pandemic, this was a terrific thing. The cash printer was on optimal power, rate of interest were low and retail financiers were all aboard the FOMO train, equipped with a healthy interest about crypto and a fat stimulus cheque.

However with the altering macro environment, the crypto market has actually freefallen from $3 trillion to $800 billion, prior to this current rise popped it back above $1 trillion.

Why are Japanese operations stopping?

Regardless of the enjoyable pump this previous couple of weeks, zooming out informs you that Coinbase has actually shed 85% of its worth given that going public, gone through 2 rounds of layoffs, seen its CEO sell 2% of his stock in October and now is stopping operations in Japan.

All Japanese Coinbase clients will have up until February 16th to withdraw their holdings from the platform. If they stop working to do so, the staying possessions will be transformed to Japanese yen. Coinbase had actually striven throughout the previous crypto winter season to broaden into the Japanese market, so the abrupt departure is a pity.

However Coinbase is not the only exchange to make this relocation, with competing Kraken likewise revealing it was stopping Japanese operations last month. Likewise like Coinbase, Kraken had actually cut a big portion of its labor force, laying off 30% of workers after the FTX collapse shook the marketplace. The predicament of Coinbase’s severe connection with the crypto market is when dealing with exchanges throughout the market.

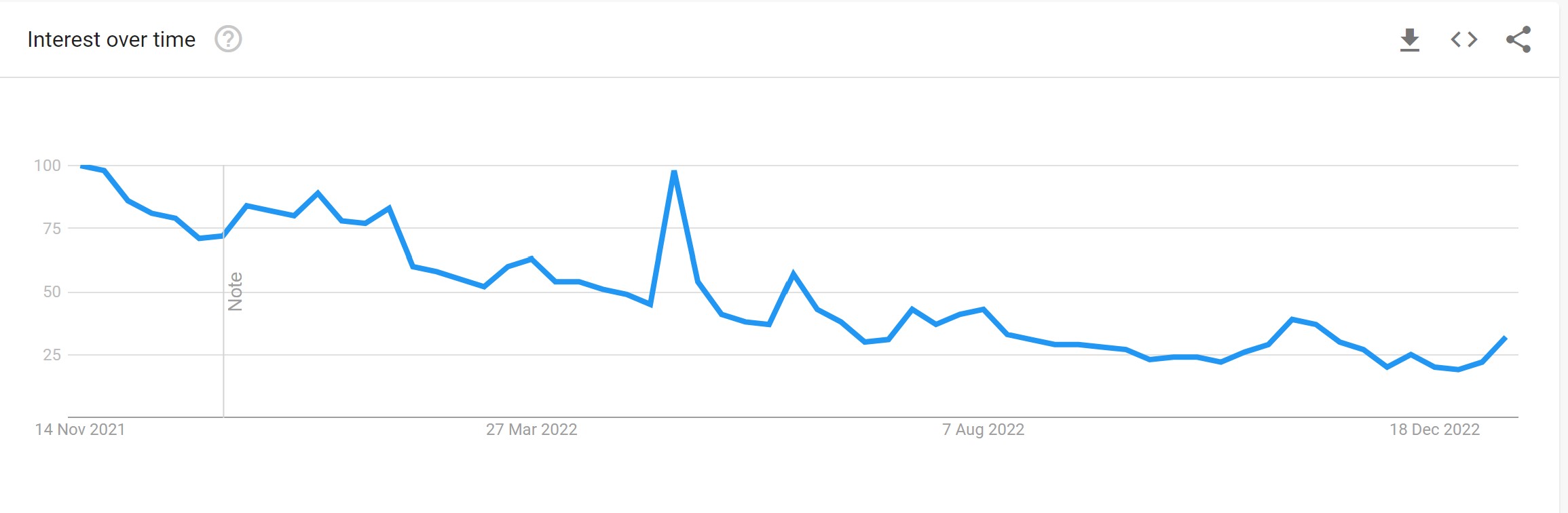

Coinbase Q3 results exposed that deal volume fell 44% from Q2. The fall in volume and interest eventually is what has actually triggered the dropping share rate, layoffs, and now stopping of Japanese operations, with a look at Google Trends all you require to see the scale of the dropoff in the general public’s attention to the exchange.

For $COIN financiers, they will hope that the last couple of weeks of softer macro information and a crypto bounceback are a prophecy of things to come, otherwise this share rate rally will be temporary.

For $COIN financiers, they will hope that the last couple of weeks of softer macro information and a crypto bounceback are a prophecy of things to come, otherwise this share rate rally will be temporary.