Discover How Bitcoin Crashed to $8,900 on This Crypto Exchange

On late Monday, Bitcoin (BTC) plunged to an impressive $8,900 on the BitMEX crypto exchange. On the other hand, other platforms revealed its worth well above $60,000.

Nevertheless, the drop was short-term, with Bitcoin rapidly recuperating to $67,000 by 23:00 UTC.

Why Did Bitcoin Crash on BitMEX

This abrupt decrease began around 22:40 UTC. Within minutes, it was up to its floor considering that early 2020. Throughout this event on BitMEX, Bitcoin’s international typical rate stayed around $67,400.

Speculation was plentiful on social networks, especially on platform X. Observers associated the Bitcoin crash to huge sell-offs by a crypto whale. Crypto scientist Syq offered insights, keeping in mind that a confidential crypto whale offered over 977 BTC in increments of 10– 50 BTC within 2 hours.

Simultaneously, BitMEX had limited withdrawals for specific accounts under analysis. Regardless of this, the exchange verified that its operations were typical and all funds were safe.

” We are examining uncommon activity in the previous couple of hours including a user selling big orders on our BTC-USDT Area Market,” BitMEX stated.

Find Out More: 7 Finest Crypto Exchanges in the U.S.A. for Bitcoin (BTC) Trading

Additionally, economic expert Peter Schiff sounded an alarm, meaning a more considerable decline. He recollected about the marketplace’s overconfidence when Bitcoin struck $69,000 in November 2021.

A year later on, Bitcoin had actually fallen listed below $16,000, a decrease of almost 80%. Schiff recommended that the present bullish belief might foreshadow an even higher crash.

Additionally, market belief has actually drifted towards severe greed, suggested by a Worry and Greed rating of 79. This index, determining feelings from 0 to 100, signifies the marketplace’s present avarice.

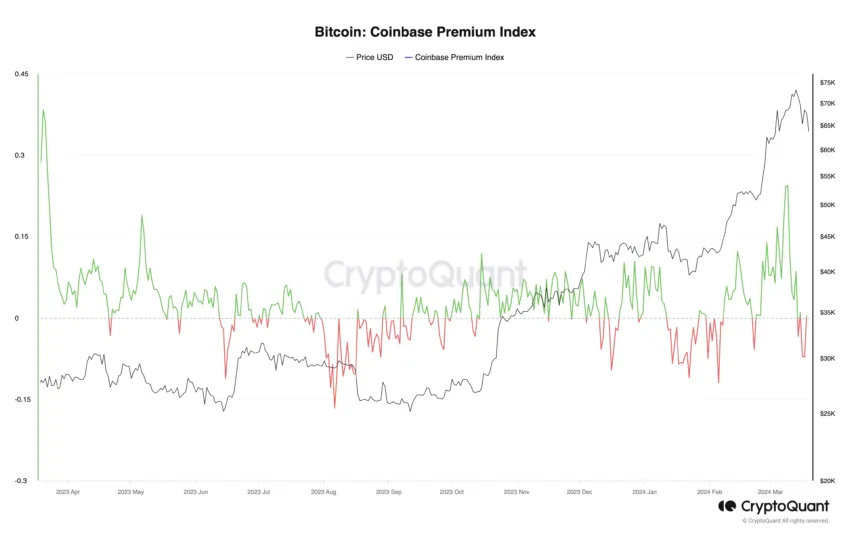

In addition, the characteristics that moved Bitcoin to tape highs have actually moved, indicating minimized United States need. The so-called Coinbase Premium sign, comparing Bitcoin rates on the US-listed Coinbase and Binance, has actually turned unfavorable.

CryptoQuant’s information recommends a drop in Bitcoin rates on Coinbase, traditionally a gauge of United States financier interest. Especially, Coinbase serves as custodian for most of the brand-new United States area ETFs.

Find Out More: What Is the Crypto Worry and Greed Index?

This shift in characteristics is highlighted by a deceleration in United States area ETF inflows. Grayscale’s ETF, for example, saw $642.5 million in outflows.

At the very same time, the Coinbase premium had actually reached a 12-month peak throughout Bitcoin’s current rise, meaning strong previous need from United States financiers.

Disclaimer

In adherence to the Trust Job standards, BeInCrypto is devoted to objective, transparent reporting. This news post intends to offer precise, prompt details. Nevertheless, readers are encouraged to validate truths separately and talk to an expert before making any choices based upon this material. Please keep in mind that our Conditions, Personal privacy Policy, and Disclaimers have actually been upgraded.